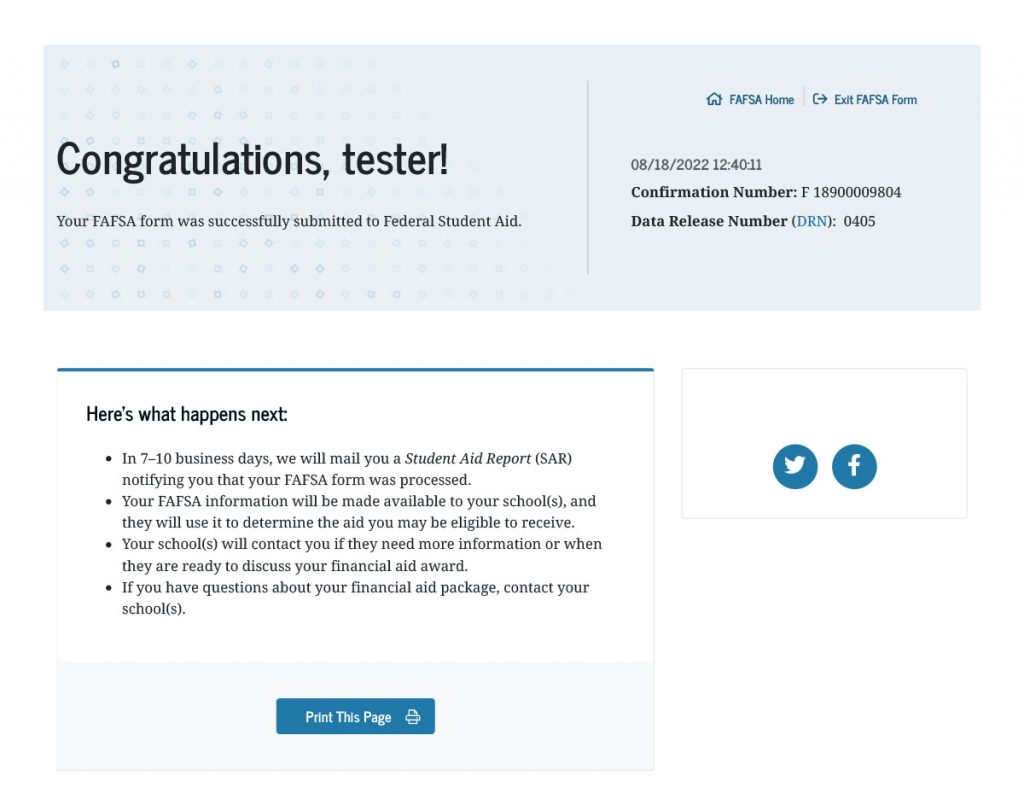

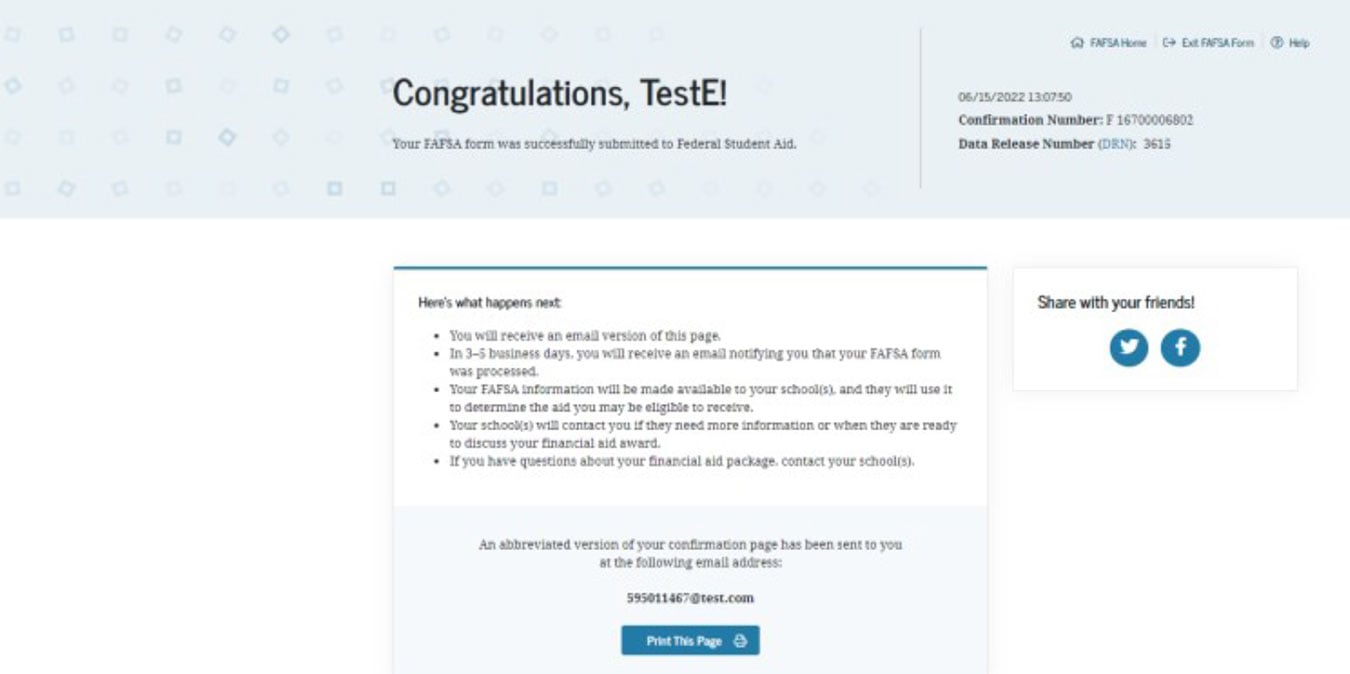

REVIEW YOUR FAFSA CONFIRMATION

- After you complete and submit the FAFSA form online, you will see a Congratulations Confirmation Page.

- This will have the Date, Time, Confirmation Number, and Date Release Number (DRN).

- This is not your financial aid offer. You’ll get that separately from the school(s) you apply to and get into.

REVIEW YOUR EFC (ESTIMATED FAMILY CONTRIBUTION)

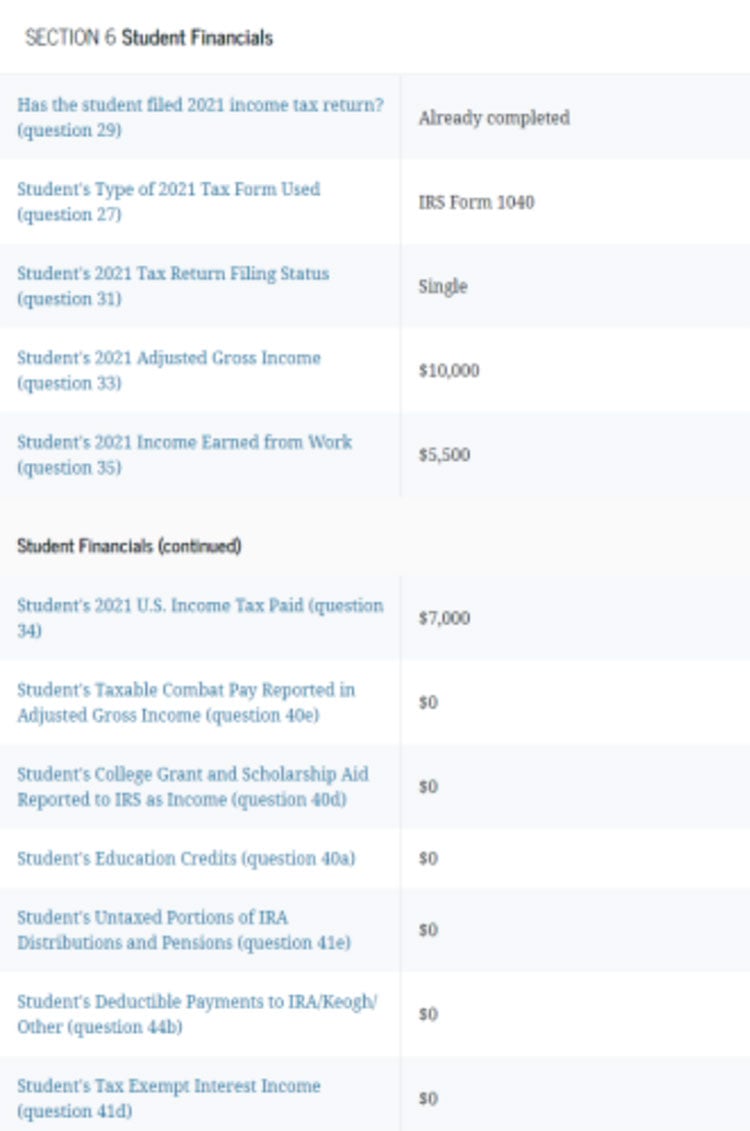

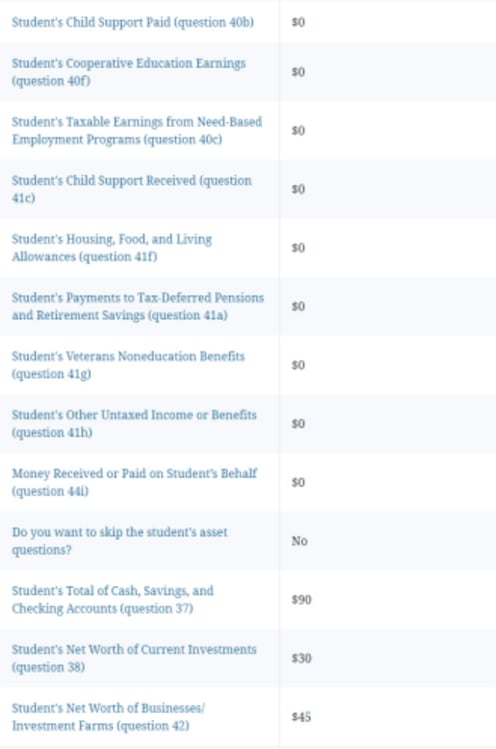

- The information you report on your FAFSA form is used to calculate your EFC.

- It’s very important to note that the EFC is not the amount of money your family will have to pay for college.

- Instead, the EFC is an index number used by financial aid offices to calculate your financial need.

- The formula they use is: Cost of attendance – EFC – estimated financial aid = Your financial “need”.

- Each school will do its best to meet your financial need.

- Some schools may meet 100% of your financial need, and other schools may only meet 10%—it just depends on the school and the financial aid they have available that year.

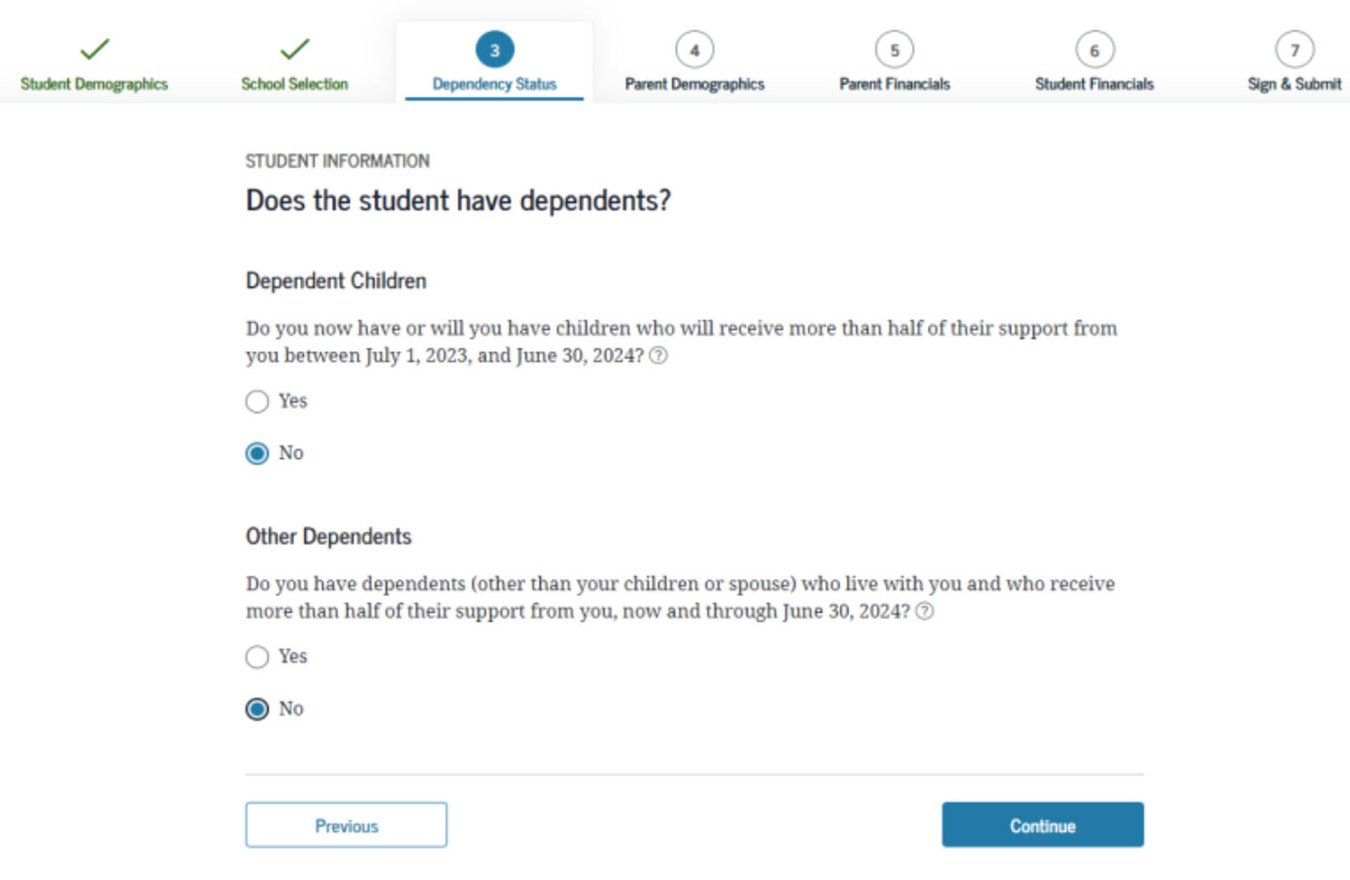

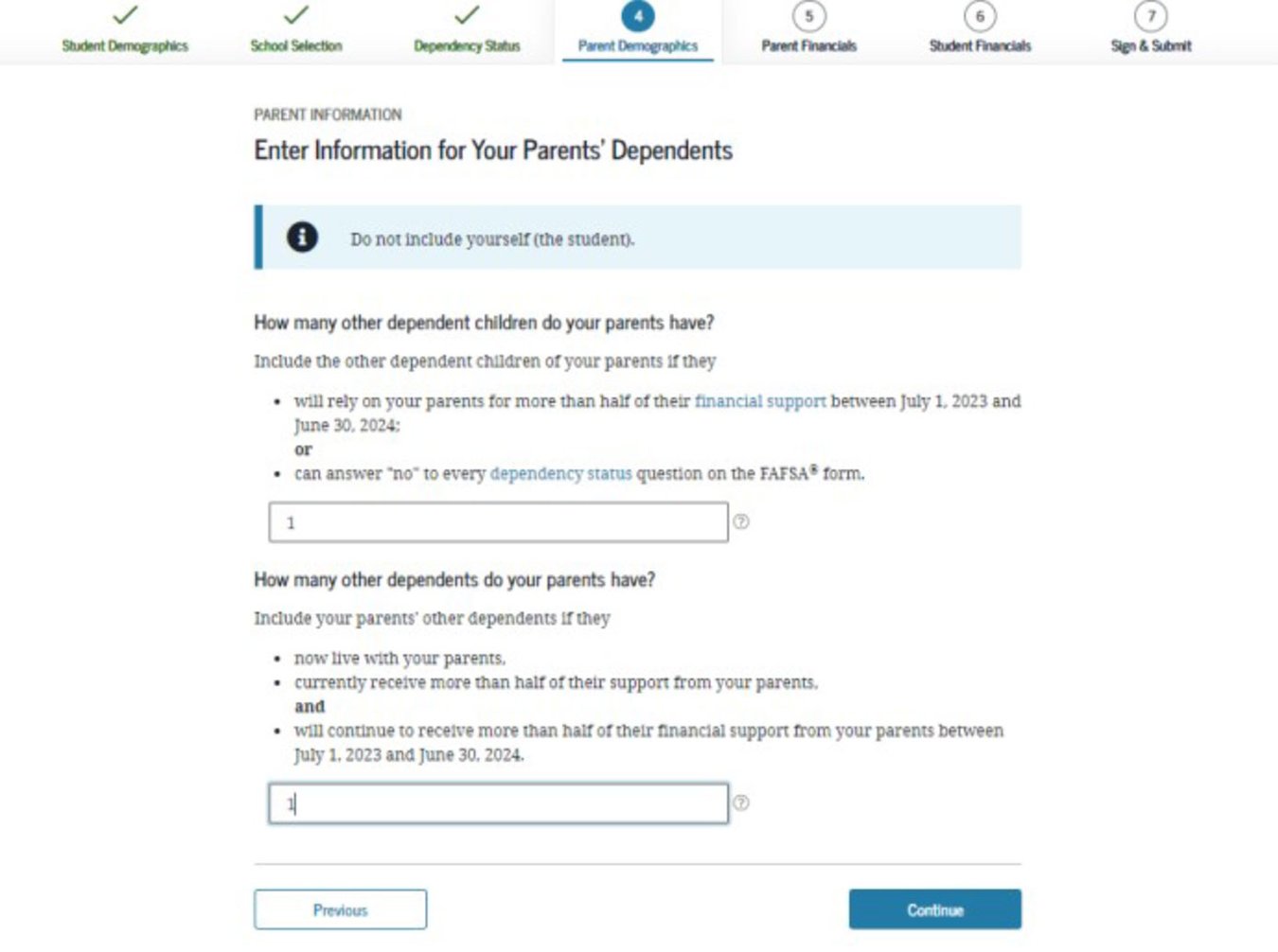

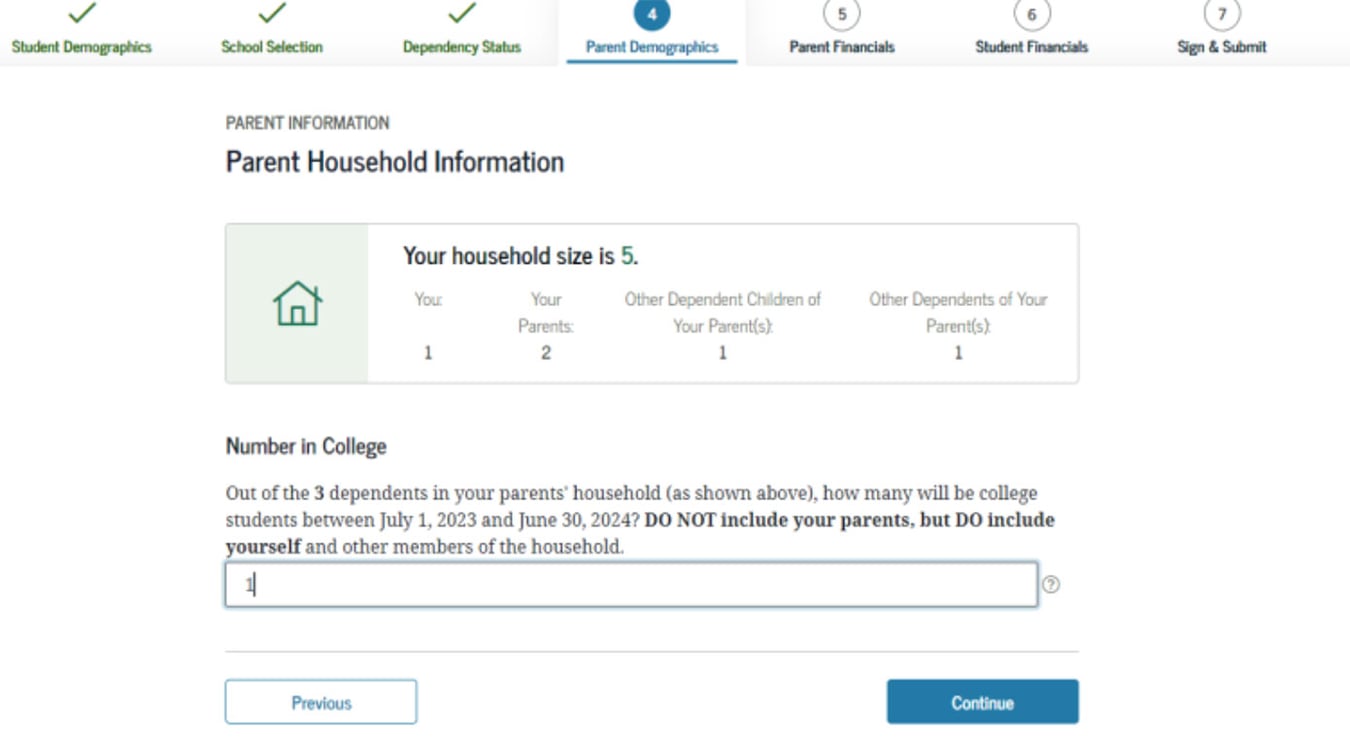

- REMEMBER: The EFC formula considers income, dependency status, family size, and the number of family members who will attend college.

SEARCH & APPLY FOR SCHOLARSHIPS

- Since many schools won’t be able to meet your full financial need, you’ll need a way to pay the difference between the financial aid your school offers and what the school costs

- ENTER TO WIN A $2,000 SCHOLARSHIP: Knowledge for College Scholarship offers students a chance to win every month!

- RISCHOLARSHIP.ORG: RISLA's College Planning Center offers a free tool to search for hundreds of free scholarships to help pay for college.

FOLLOW UP WITH SCHOOLS YOU APPLIED TO

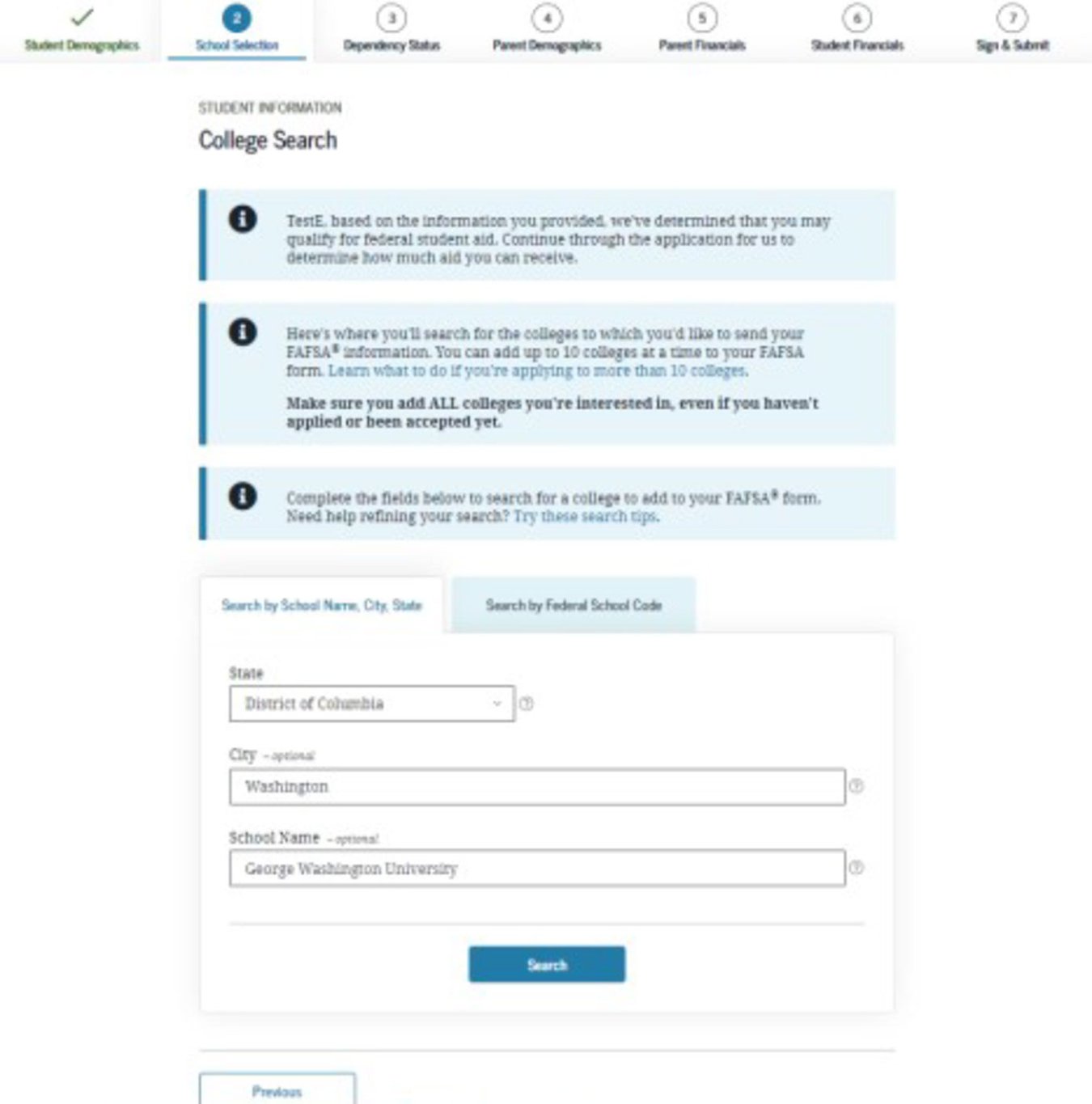

- After your FAFSA form has been processed successfully, it’s a good idea to make sure the schools you listed on your FAFSA form have received everything they need.

- Find out if your school requires additional applications or documentation and submit any required information by the appropriate deadlines.

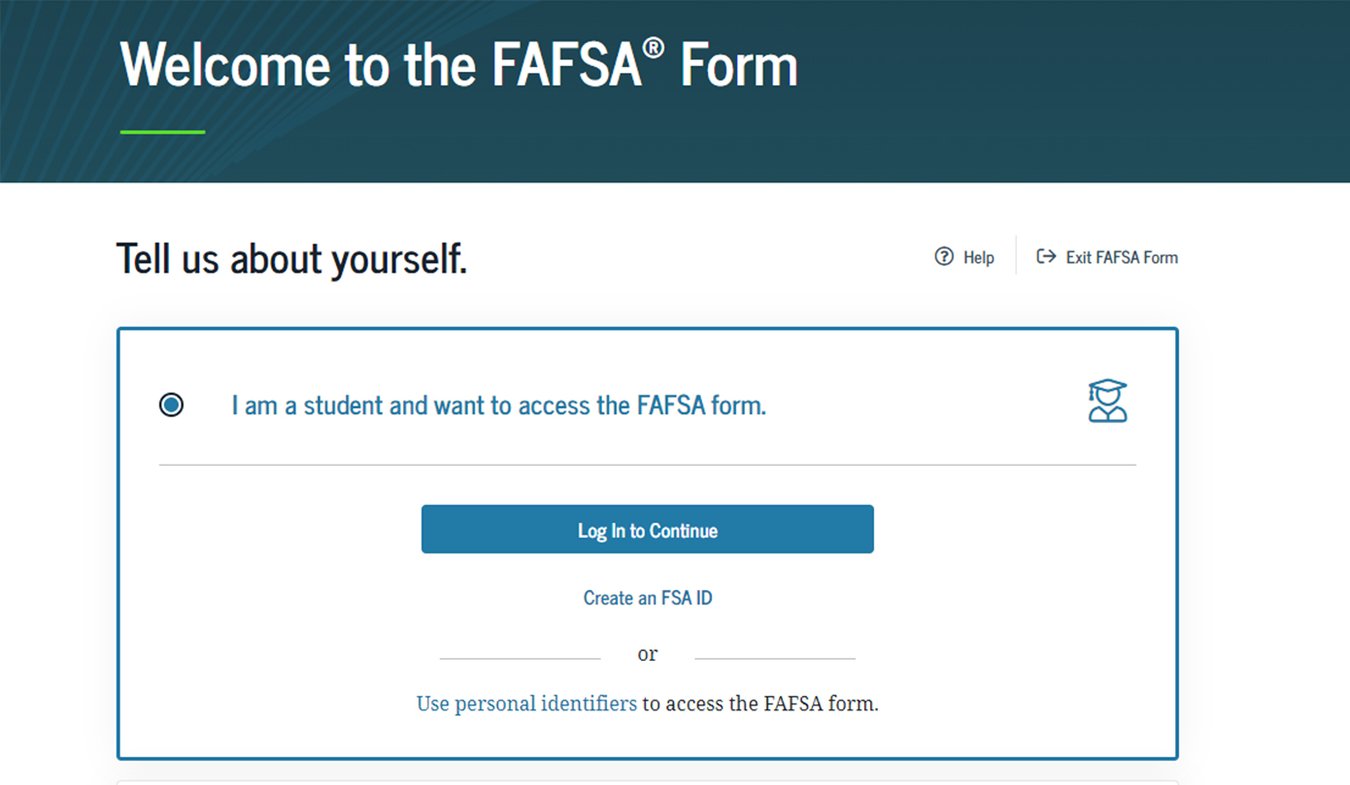

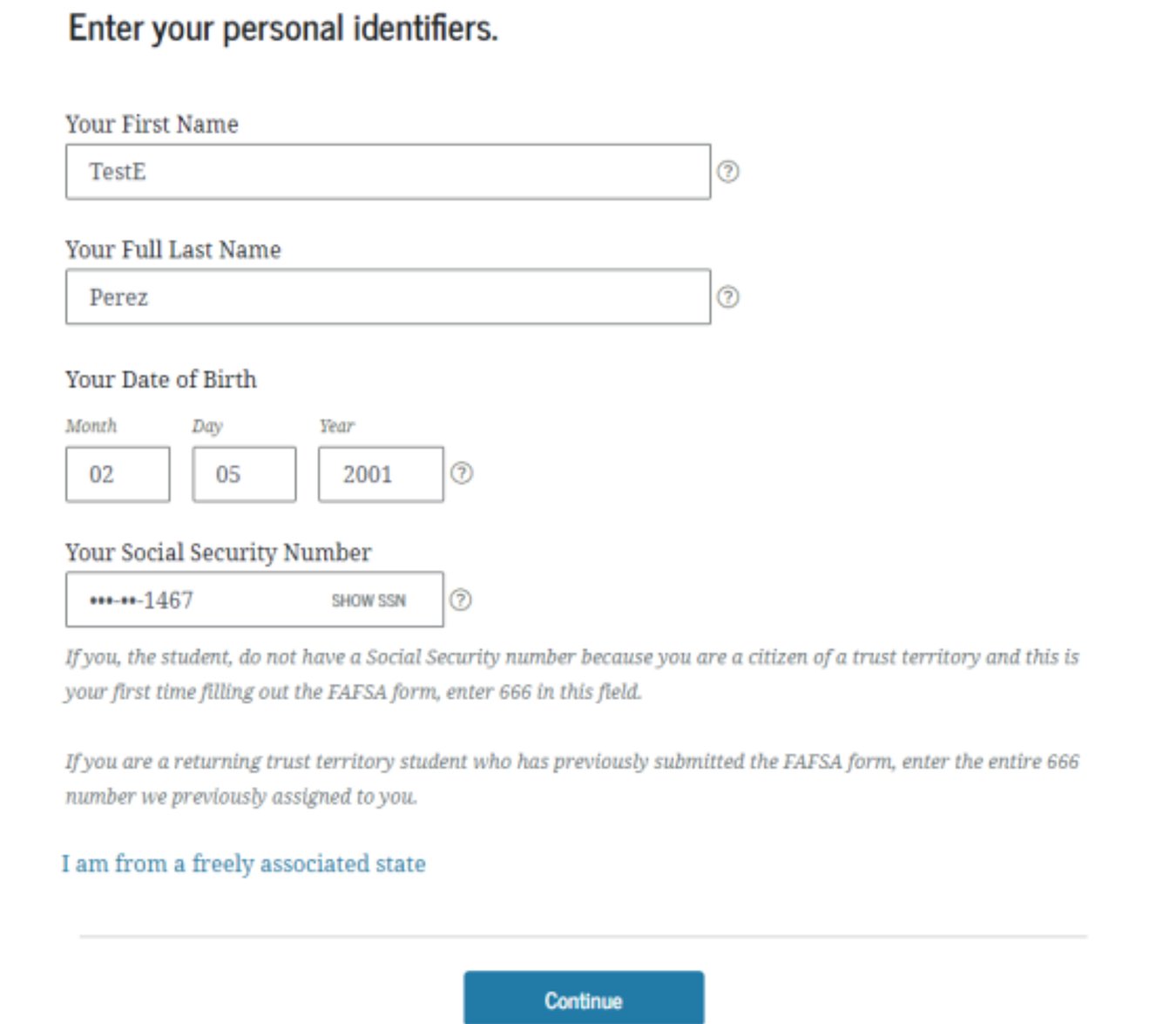

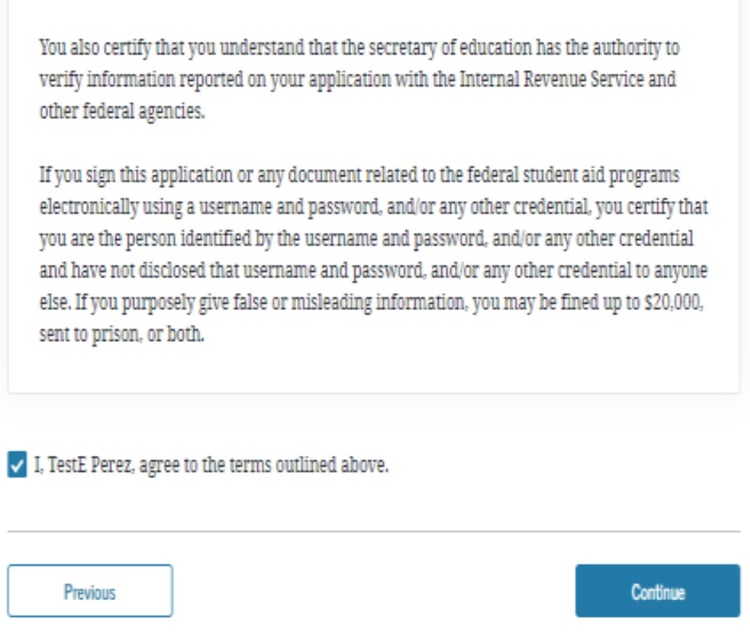

FAFSA CORRECTIONS

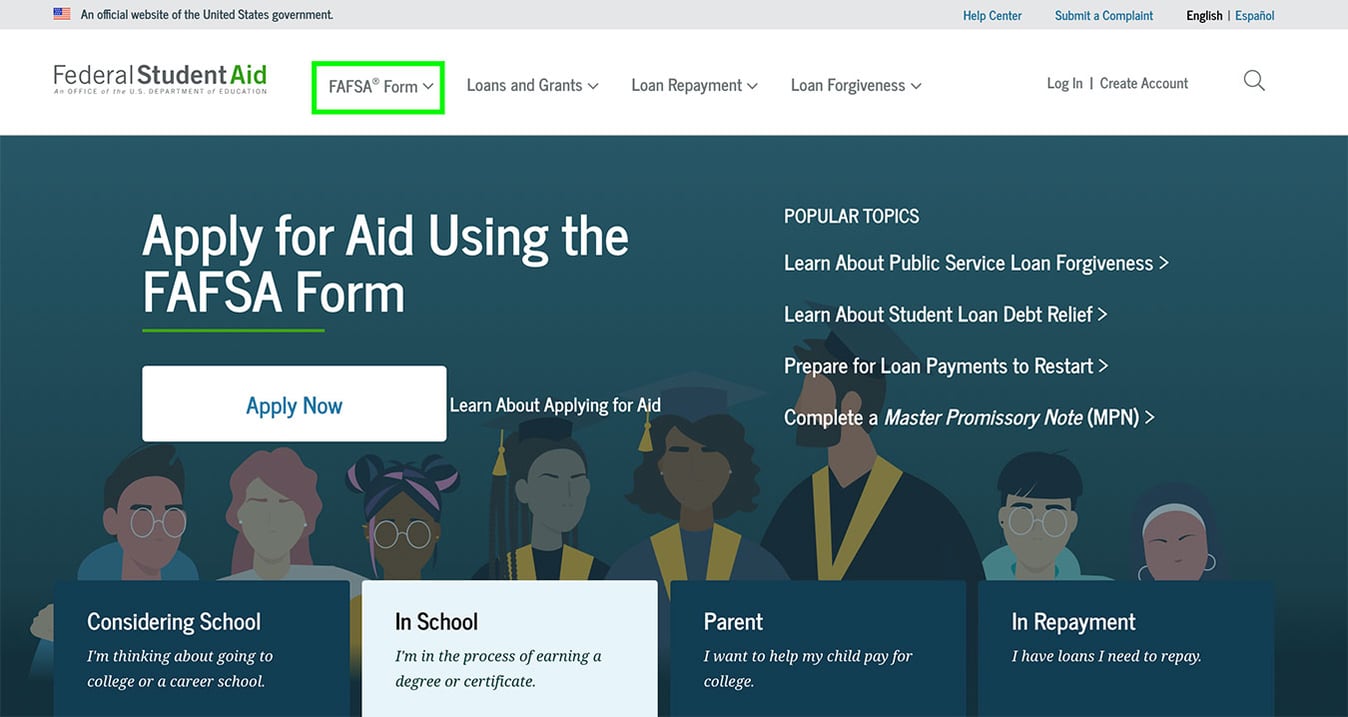

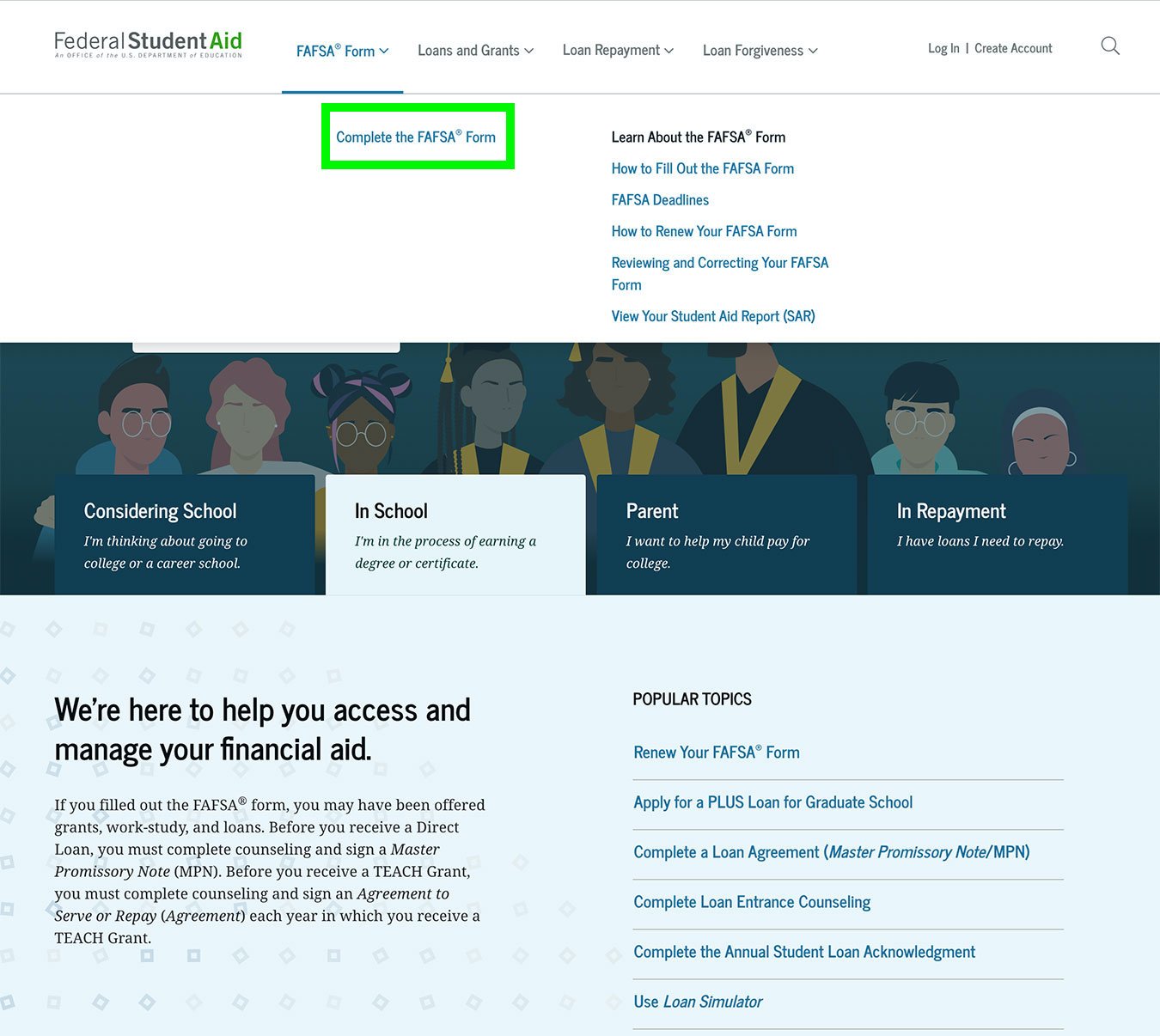

- After your FAFSA form has been processed (which takes about three days), you can go back and submit a correction to certain fields.

- This includes correcting a typo or adding another school to receive your FAFSA information.

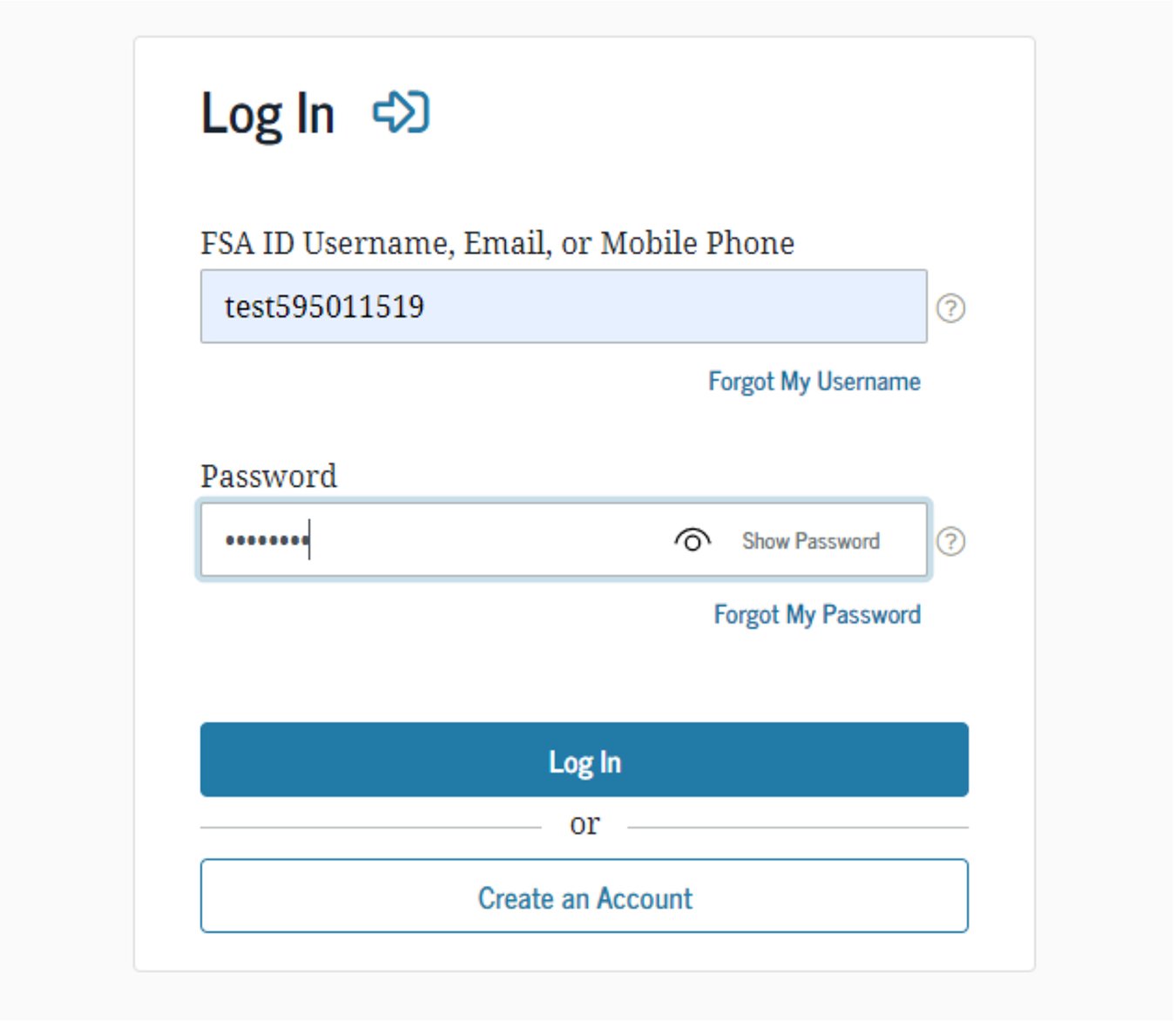

- Log in with your account username and password (FSA ID) at studentaid.gov, and then select “Make Corrections.”

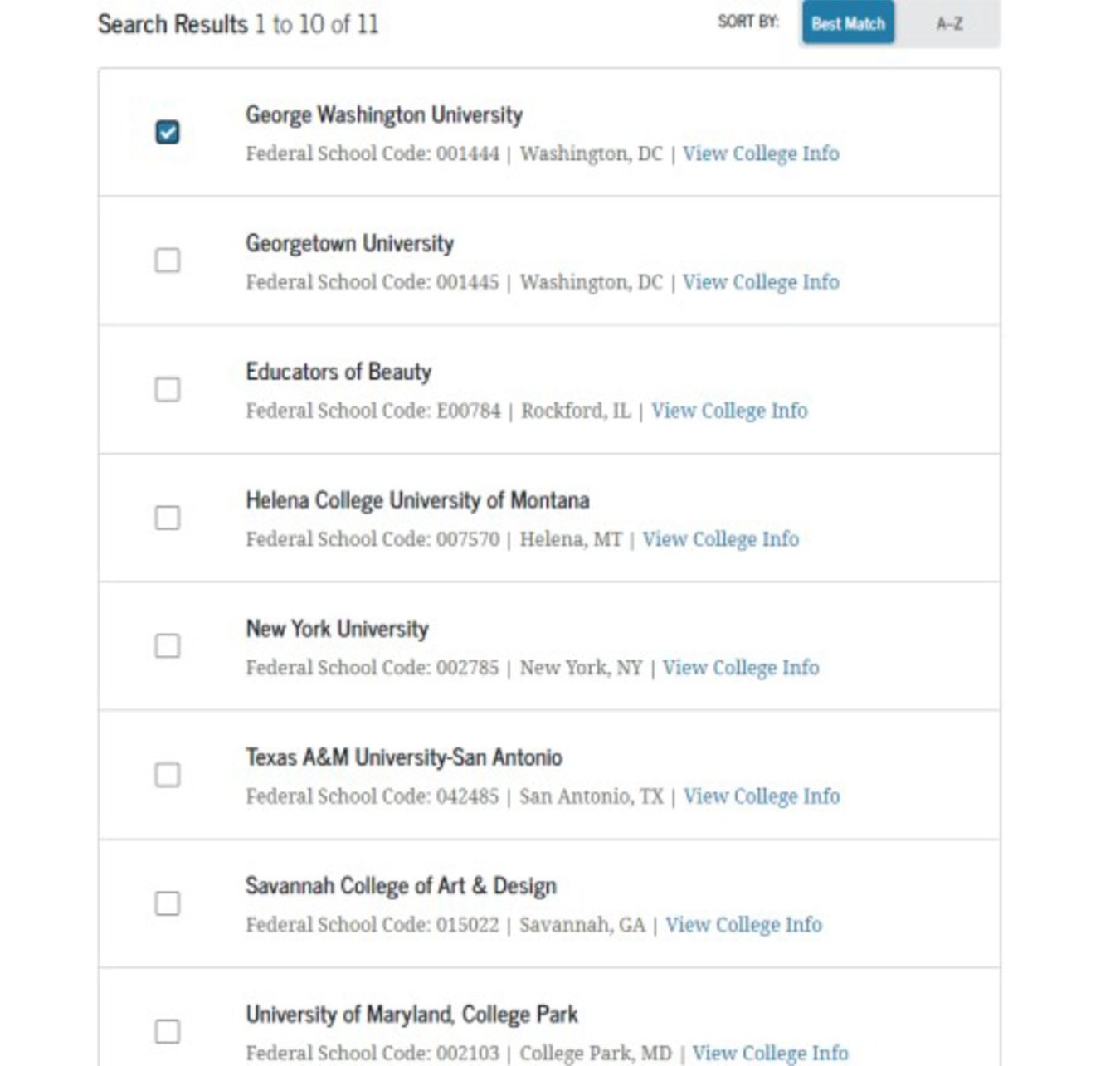

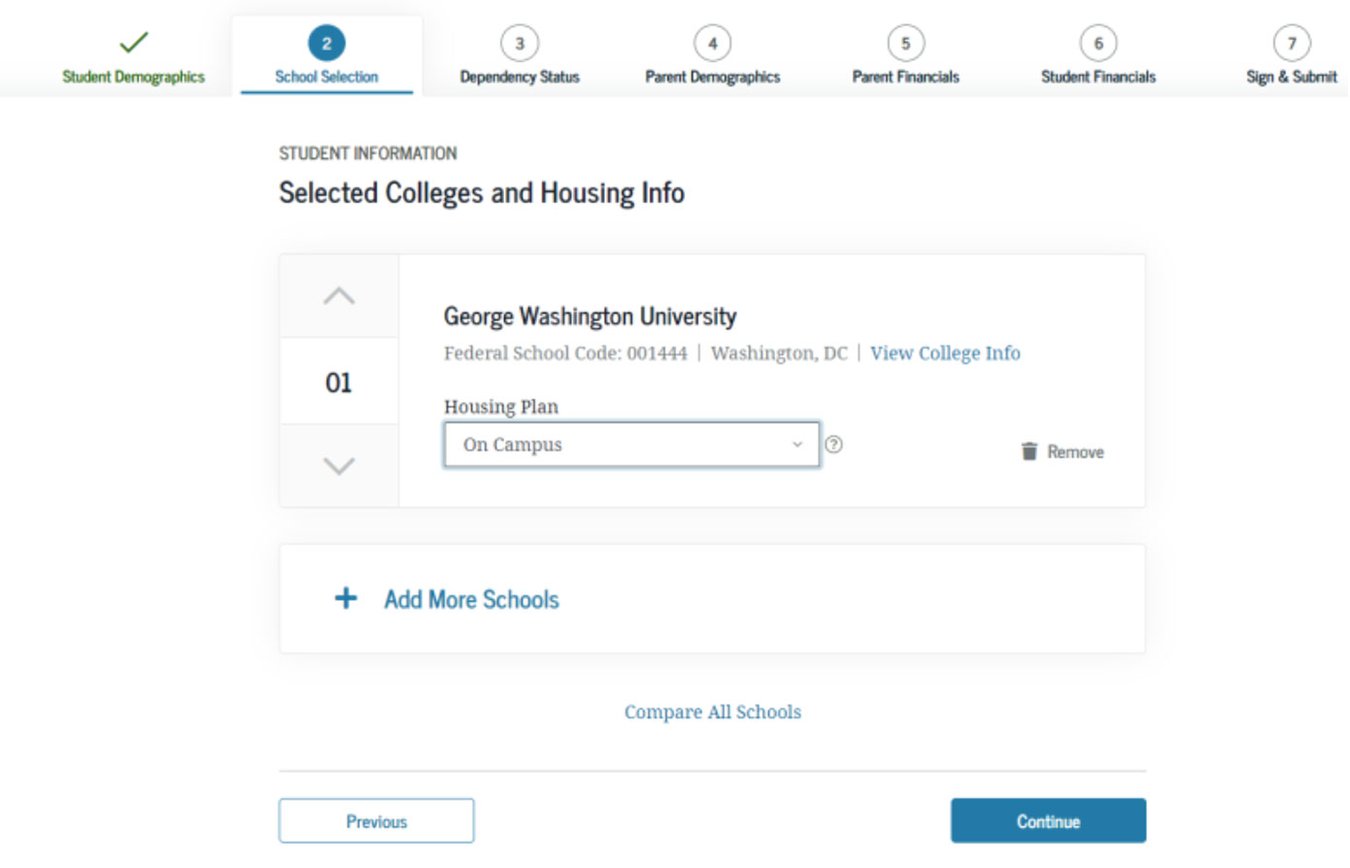

- You can add up to 10 schools at a time. If you’re applying to more than 10 schools, you have a few options to add more schools to the FAFSA form.

- If you want to report significant changes in your family or financial situation, contact your school’s financial aid office.

_1200X1200_OPTIMIZED.jpg?width=250&height=250&name=CPC_HOME_PAGE_STOCK_IMAGES-(1)_1200X1200_OPTIMIZED.jpg)

%20(2200%20%C3%97%20800%20px).png?width=2200&height=800&name=KNOWLEDGE%20FOR%20COLLEGE%20-%20LOGOS%20-%2001%20(2500%20%C3%97%201080%20px)%20(2200%20%C3%97%20800%20px).png)