Start your search for free college scholarships today! rischolarships.org!

THE FSA ID GUIDE | FOR PARENTS & STUDENTS

WHAT TO KNOW ABOUT CREATING A FSA ID.

WHAT IS MY FSA ID?

The FSA ID is a username and password combination you use to log in to U.S. Department of Education (ED) online systems. The FSA ID is your legal signature and shouldn't be created or used by anyone other than you—not even your parent, your child, a school official, or a loan company representative.

LOOKING FOR MORE INFORMATION?

Talk with RISLA's College Planning experts! They can answer any questions you may have and assist with the FSA ID completion process.

KNOWLEDGE FOR

COLLEGE SCHOLARSHIP

A chance to win a $2,000 scholarship to help pay for college! Four students are randomly selected each month.

FAFSA DELAYED FOR 2023

According to Federal Student Aid, the improved FAFSA form will be available for students and parents by Dec. 31, 2023. This delay will affect both current college students and the high school Class of 2024.

Click to receive additional updates: FAFSA NOTIFICATION

HOW TO GET STARTED WITH YOUR FAFSA

PARENTS & STUDENTS MUST CREATE A FSA ID

For parents and students, having a FSA ID prior to starting the FAFSA is the fastest way to sign your application and have it processed. It’s also the only way to access or correct your information online or to prefill an online FAFSA form with information from your previous year’s FAFSA form.

FSA ID | CREATE AN ACCOUNT

CREATE AN ACCOUNT

- Go to studentaid.gov

- Click "Create Your FSA ID Now"

PRO TIPS

Required for Parent(s) and Students- First and Last Name: Must match exactly what is on your SSN Card

- Date of Birth

- Social Security Number: Parent(s) and student must have a SSN

- Email Address: Email cannot be shared by parent(s) and student or used multiple times.

- Physical Address

- Mobile Phone Number

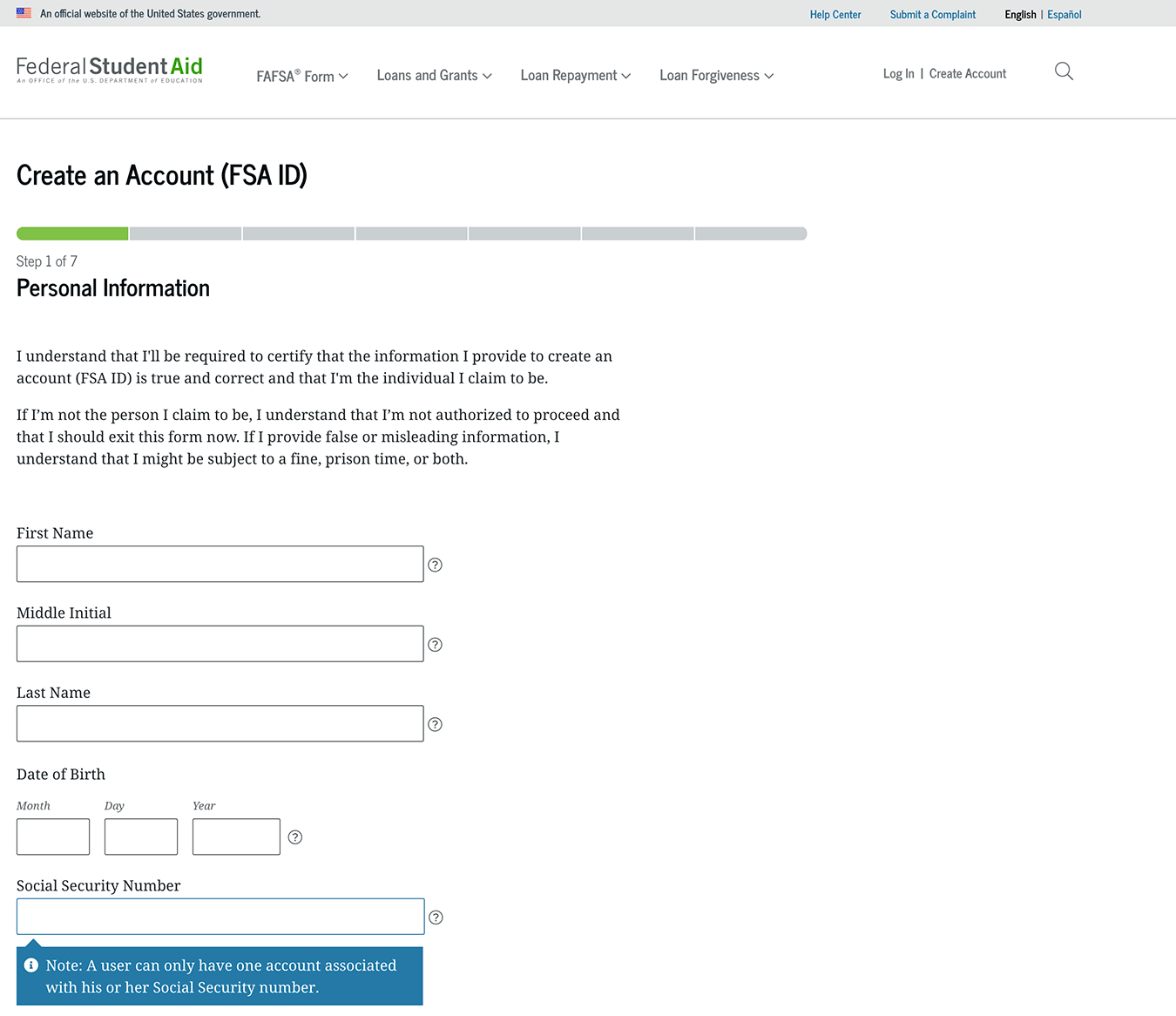

FSA ID | STEP 1 | PERSONAL INFORMATION

PERSONAL INFORMATION

- Parent(s) and Students: Enter your name, birthdate, and social security number.

PRO TIP

- Remember it must exactly match your social security card!

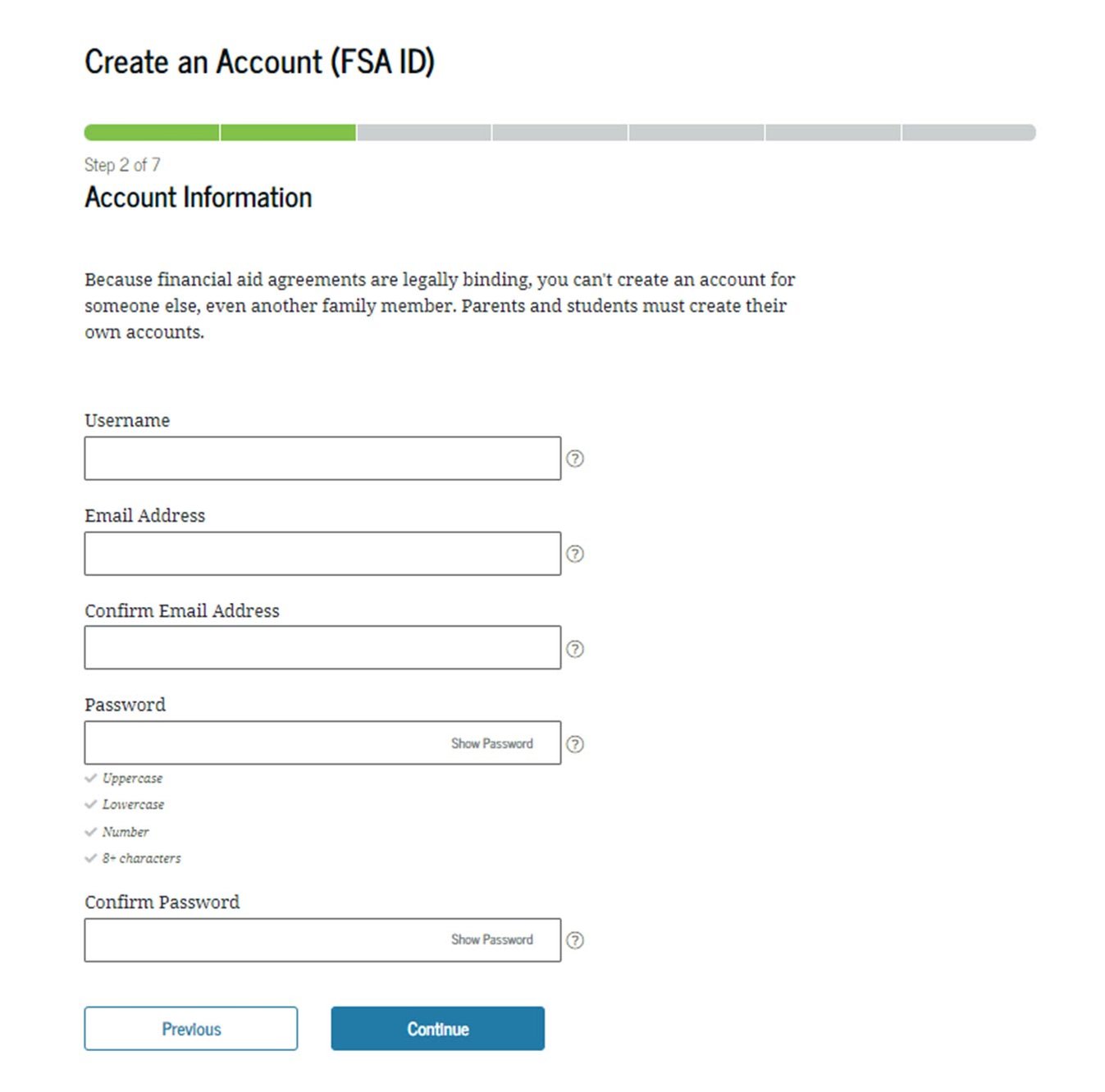

FSA ID | STEP 2 | ACCOUNT INFORMATION

ACCOUNT INFORMATION

- Parent(s) and Students: Create a username, email address, and password.

PRO TIPS

- Remember to safely store your usernames and password!

- Use an active, non-school email address.

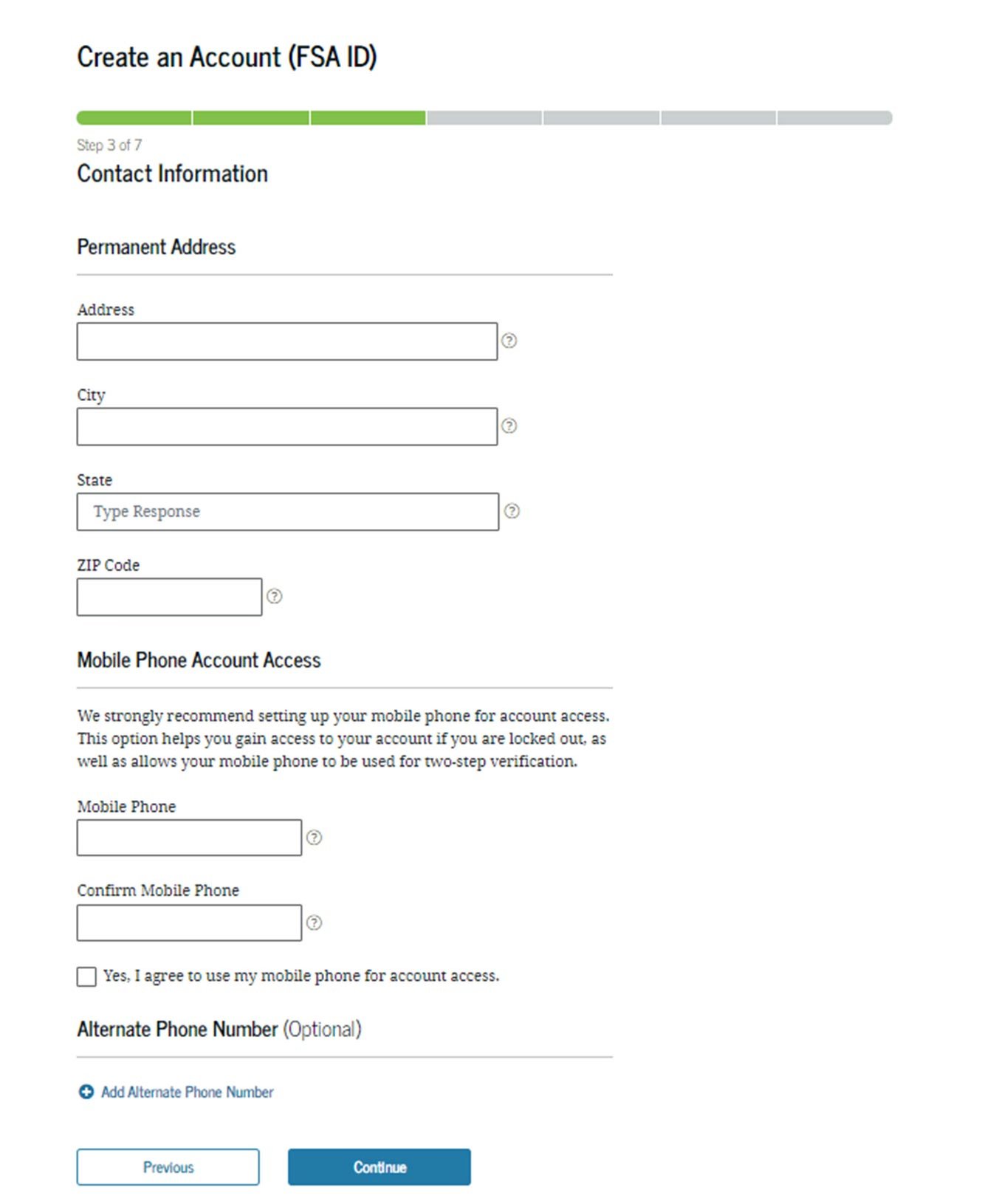

FSA ID | STEP 3 | CONTACT INFORMATION

CONTACT INFORMATION

- Parent(s) and Students: Enter your current permanent address.

PRO TIP

- Have your mobile phone ready when completing your FSA ID. You will have to verify your information via email and mobile.

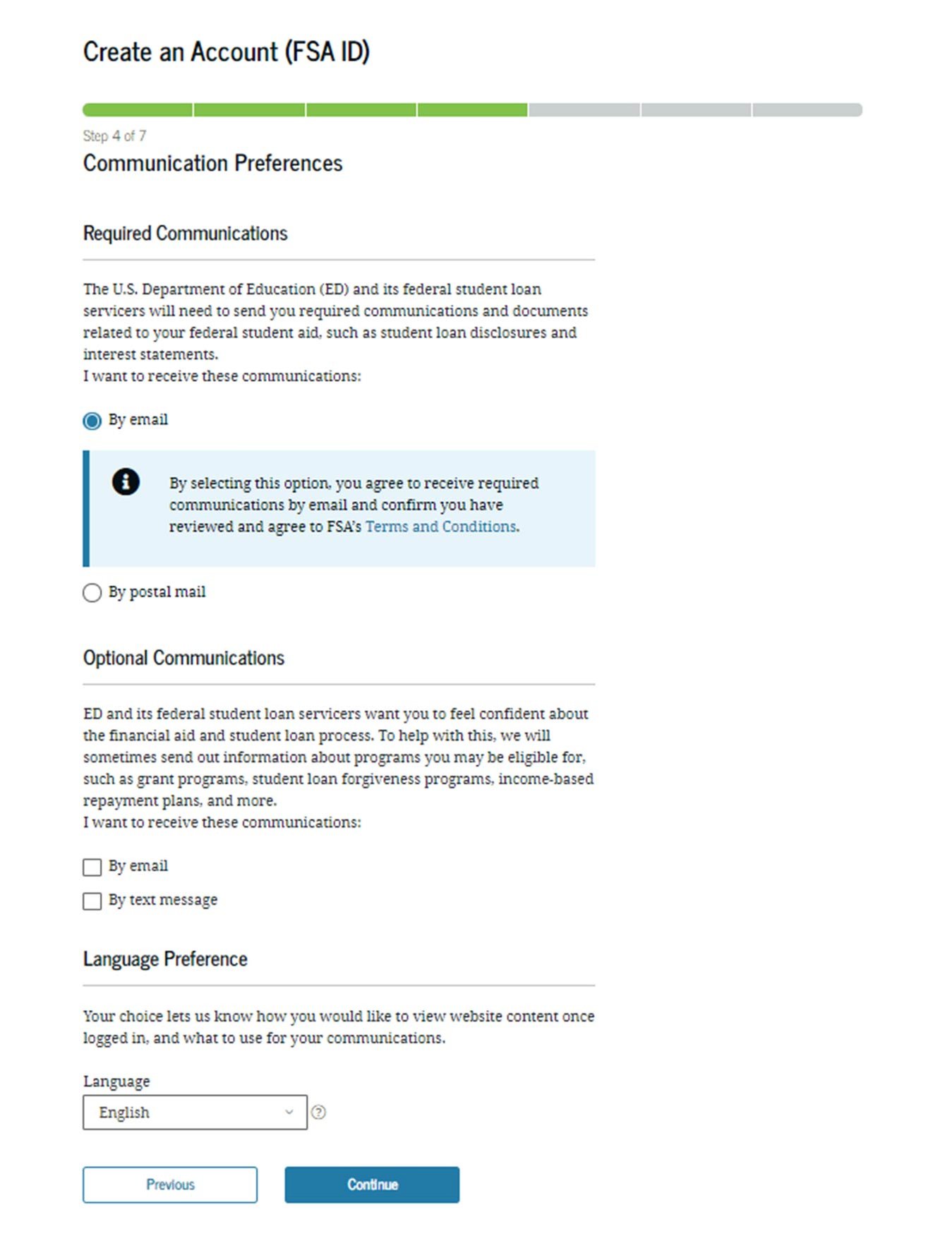

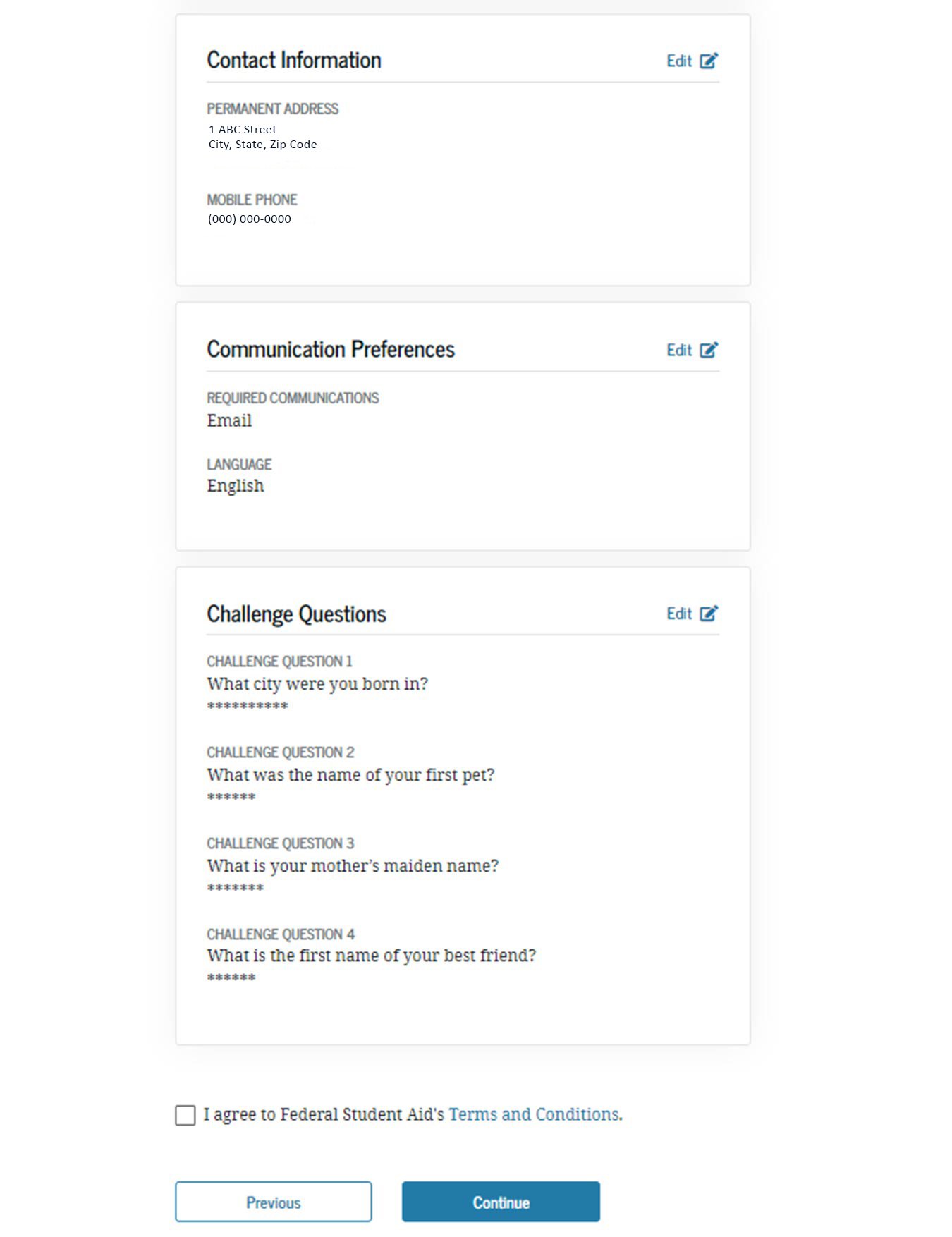

FSA ID | STEP 4 | COMMUNICATION PREFERENCES

COMMUNICATION PREFERENCES

- Parent(s) and Students: Here you will choose how you will choose your preference of communication: by email or by postal mail.

PRO TIP

- It is strongly recommended to choose "by email".

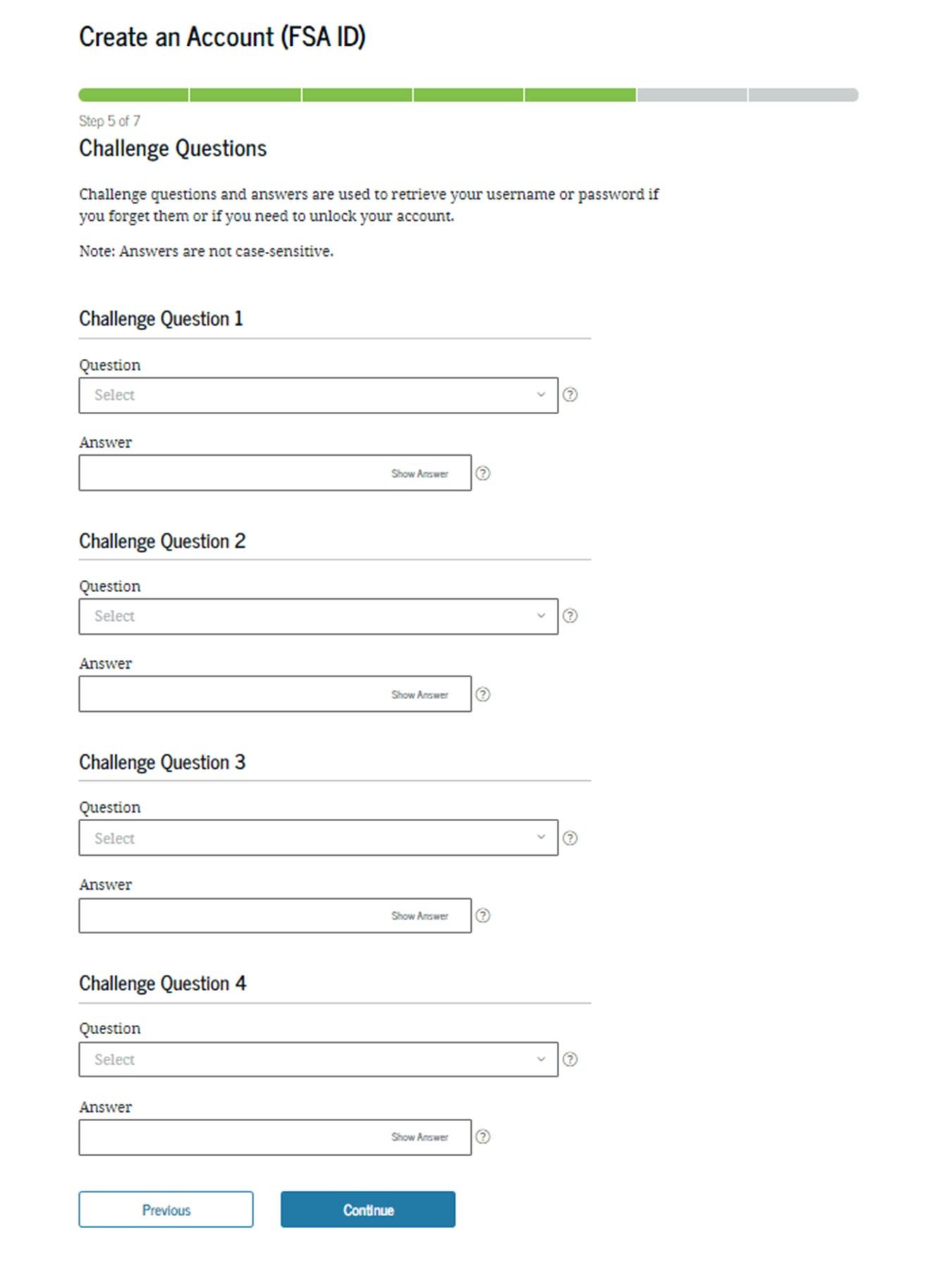

FSA ID | STEP 5 | CHALLENGE QUESTIONS

CHALLENGE QUESTIONS

- Parent(s) and Students: This is information to retrieve your username and password.

PRO TIP

- This information is usually personal. It is suggested that you take a screenshot of the information when complete or safely store the information to use when needed.

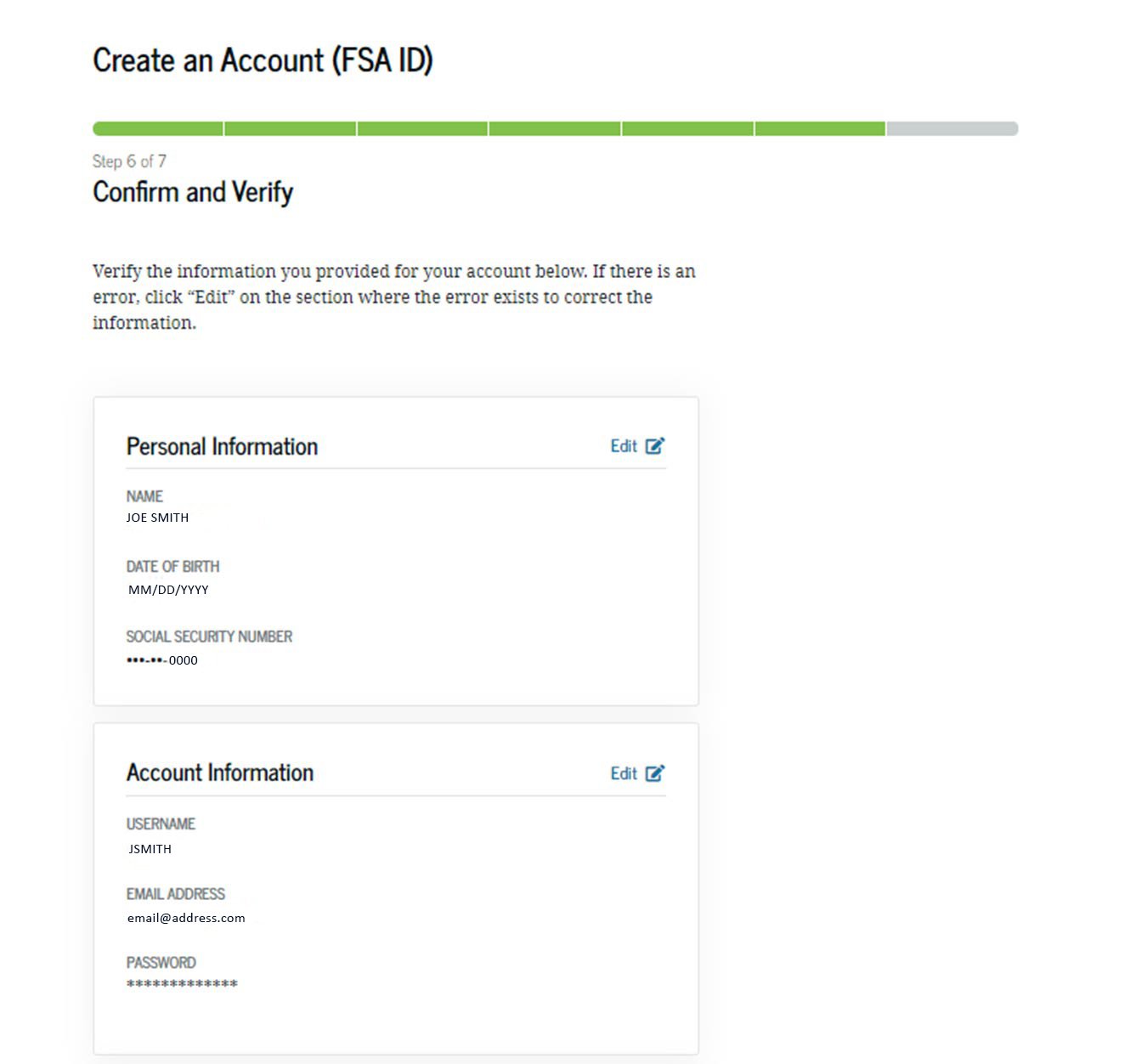

FSA ID | STEP 6 | CONFIRM & VERIFY

CONFIRM & VERIFY

- Parent(s) and Students: Confirm that the information provided is correct and edit if needed.

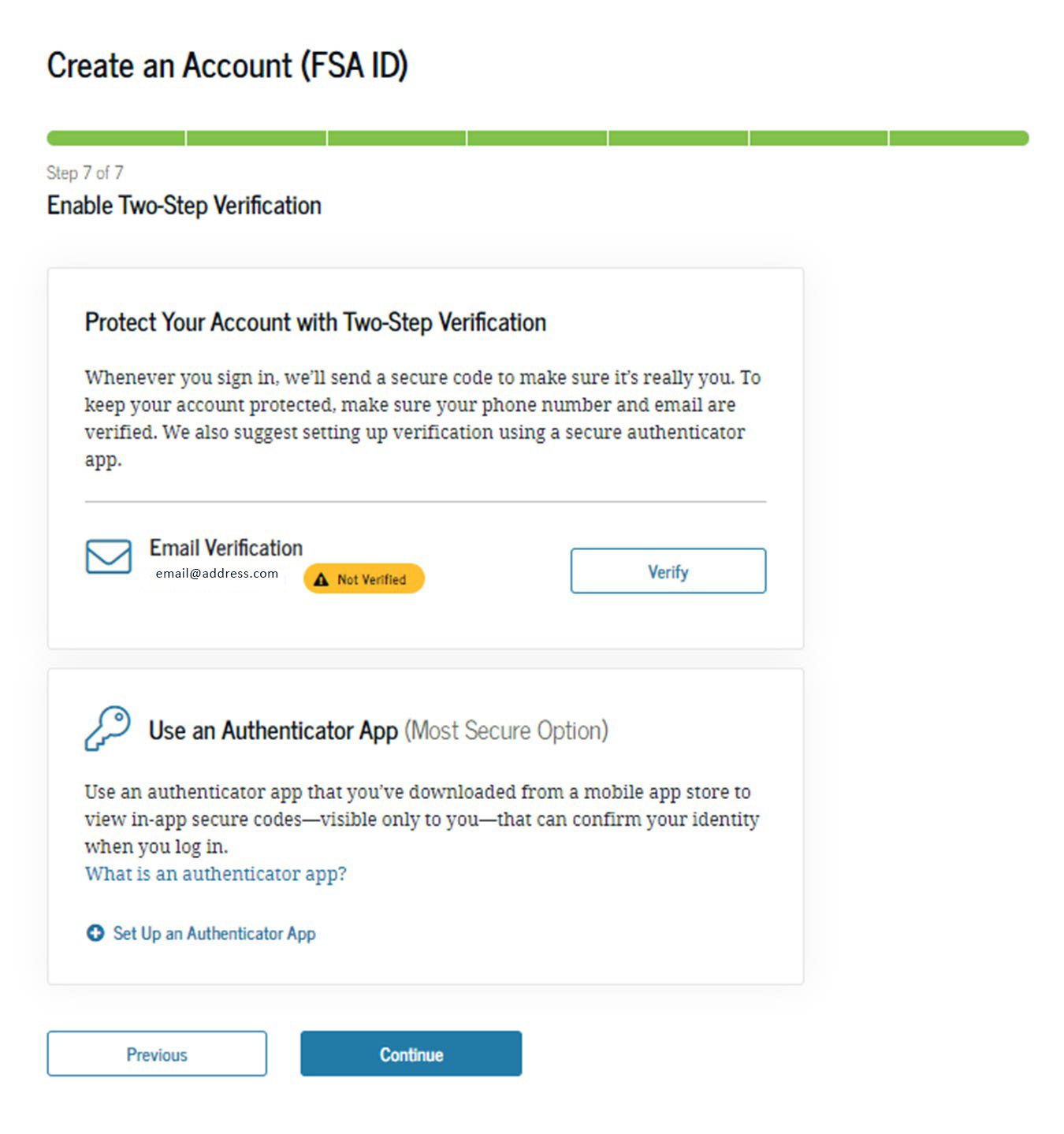

FSA ID | STEP 7 | ENABLE TWO-STEP VERIFICATION | NOT VERIFIED

ENABLE TWO-STEP VERIFICATION | NOT VERIFIED

- Parent(s) and Students: You will need your mobile phone, desktop, or laptop computer to receive an email verification.

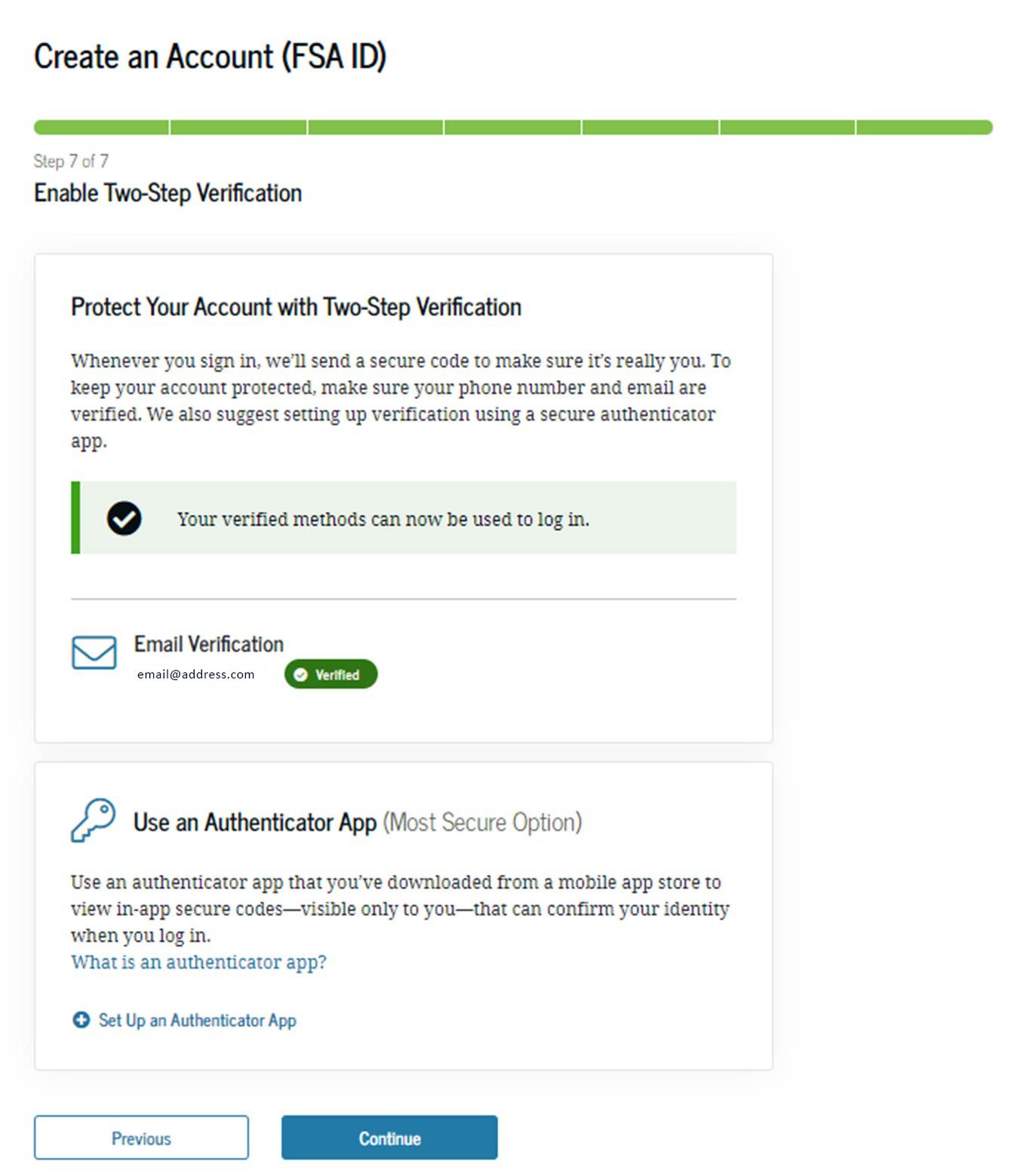

FSA ID | STEP 7 | ENABLE TWO-STEP VERIFICATION | VERIFIED

ENABLE TWO-STEP VERIFICATION | VERIFIED

- Parent(s) and Students: You have been verified! When you sign in you will be sent a secure code to make sure it is really you!

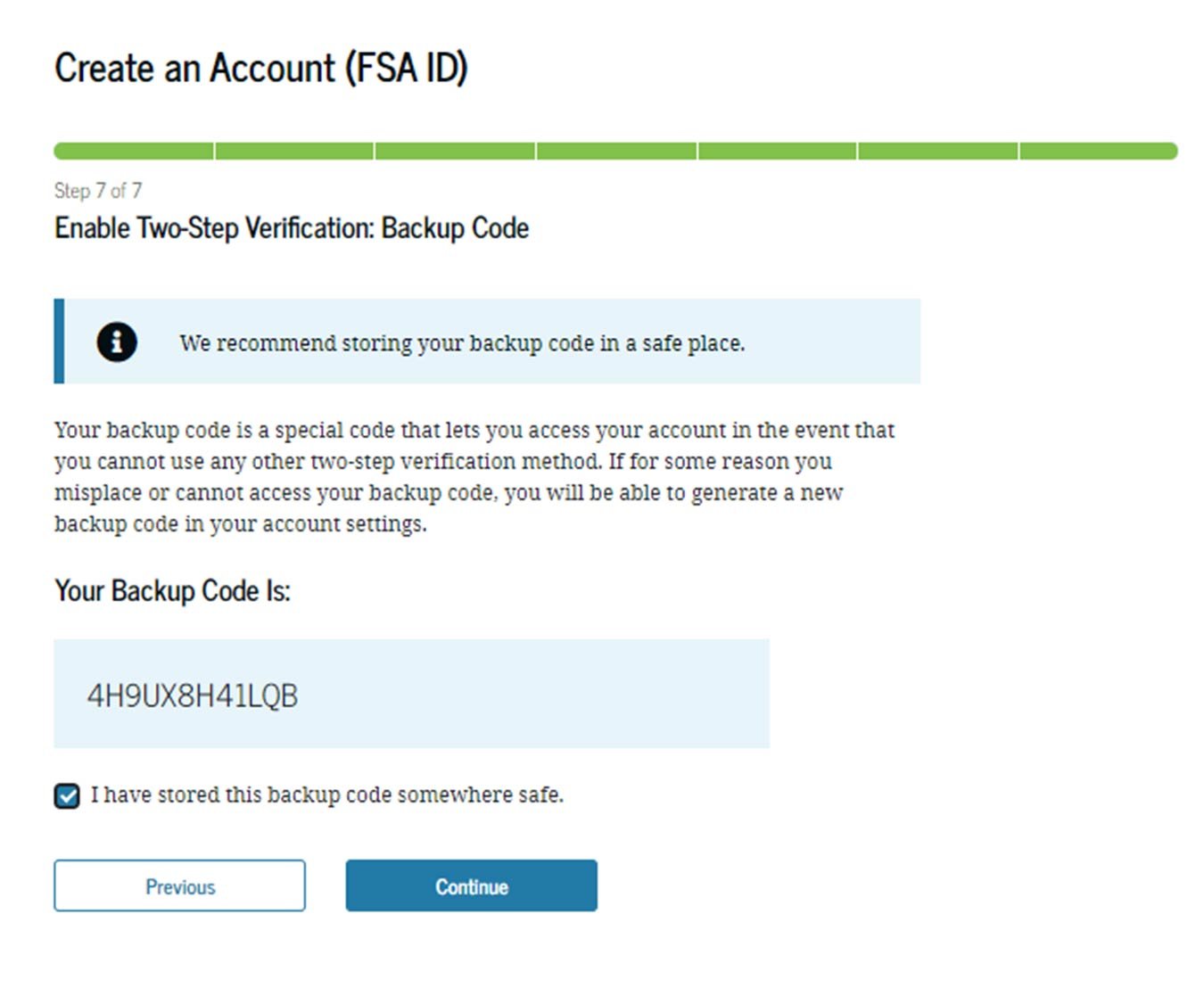

FSA ID | STEP 7 | ENABLE TWO-STEP VERIFICATION | BACKUP CODE

ENABLE TWO-STEP VERIFICATION | BACKUP CODE

- Parent(s) and Students: Safely store this code where you can access it when you can not use the two-step verification method.

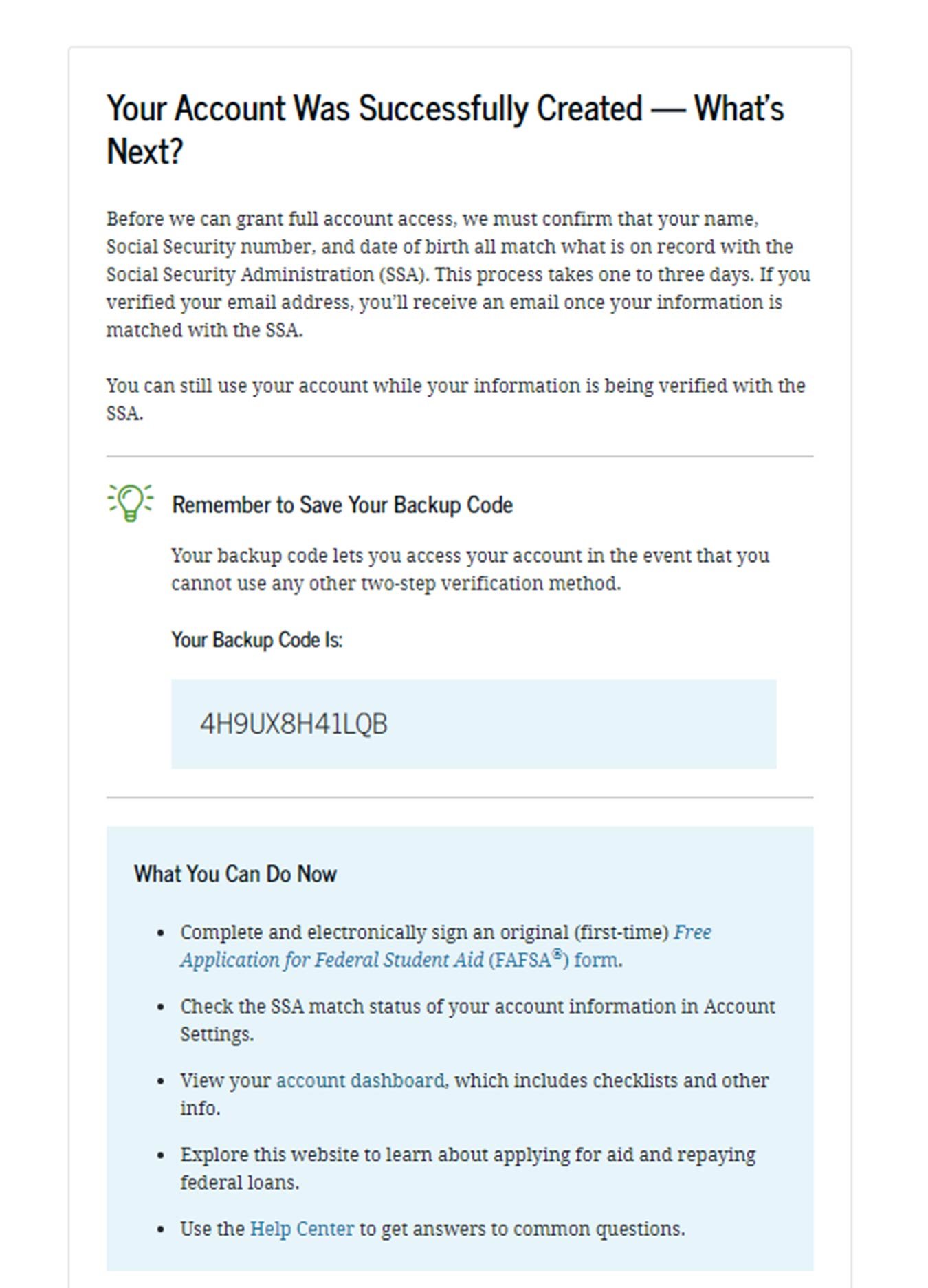

FSA ID | ACCOUNT SUCCESSFULLY CREATED

ACCOUNT SUCCESSFULLY CREATED

- Parent(s) and Students: This is the final confirmation that your account has been successfully created and you can log in.

FSA ID | VIDEO TUTORIAL

START YOUR SEARCH TODAY

RISCHOLARSHIP.ORG

RISLA provides a free search tool for college scholarships.

QUESTIONS ABOUT COLLEGE PLANNING?

Schedule an appointment with one of our experts.

HOW TO PREPARE FOR FAFSA

Money for college starts with FAFSA

Everyone should complete the FAFSA which can qualify students for grants, scholarships, federal student loans, and work-study.

ACCOUNT BALANCES

Balances of checking & saving accounts for parent(s) and student.

COLLEGE LIST

A list of schools that students will be applying to.

TAX RETURN

W2 OR PAY STUBS

Printed copies are required for parent(s) and student.

MARRIAGE & DIVORCE

Parents are required to provide the date of marriage or divorce.

IT'S NEVER TOO EARLY TO START

COLLEGE PLANNING

If you need assistance at any point in the college planning process, free help is available.

Simply schedule an appointment with the RISLA College Planning Center. The counselors can walk you through every step of the way, help you access financial aid, and answer your difficult college planning questions.

For high school seniors, it's not to late, we can catch you up quickly with the college planning timeline provided below.

RISLA PRODUCTS & SERVICES

COLLEGE PLANNING CENTER

Students and families can be overwhelmed with planning and how to pay for college. We have experienced counselors that offer one on one assistance helping families understand all their options start to finish.

EDUCATION LOANS

We have been offering low cost, fix rate education loans for almost 30 years. Helping students and families borrower responsibly to help achieve their higher education dreams.

REFINANCE

Refinancing may help you simplify and save when repaying student loans. Combining outstanding balances, and securing a low interest rate with RISLA may reduce your overall repayment amount and possibly your monthly payment.

EMPLOYER REPAY

Employer Student Loan Repayment assistance is a tax-free benefit allowing employers to contribute towards the repayment of employee student loans. This newest in-demand employee benefit helps reduce financial stress for employees while increasing retention and loyalty to employers.