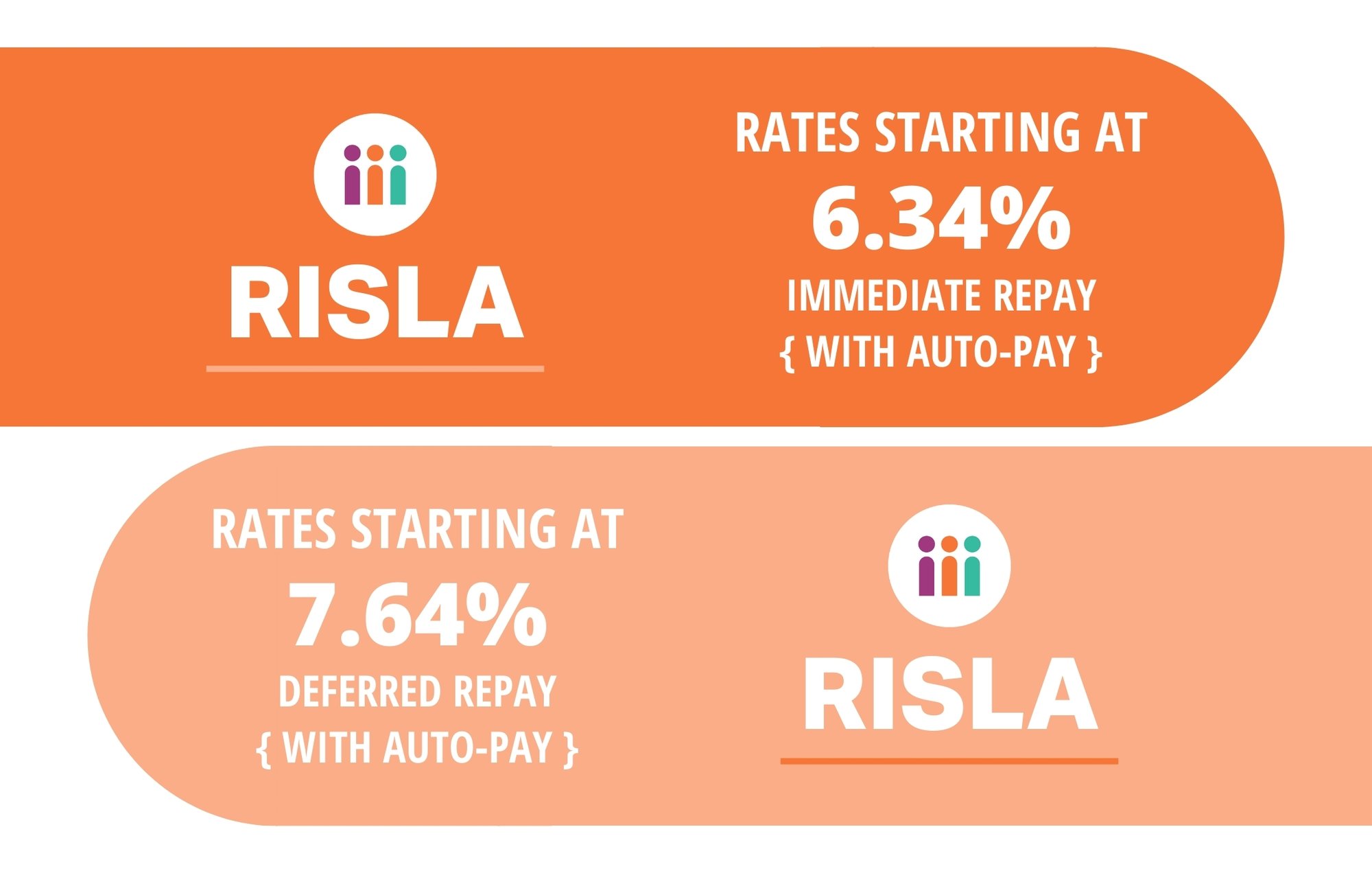

1. THE ANNUAL PERCENTAGE RATE (APR) IMMEDIATE REPAY: Reflects the estimated total cost of the loan, including upfront fees ($0), accruing interest, and the effect of capitalized interest ($0). Interest begins accruing after each loan disbursement. Rates shown include the 0.25% interest rate reduction for using the auto-pay feature. If the monthly payment is calculated to be less than $50 per month for the full term, the lowest payment is $50 per month with the term reduced. Not all borrowers qualify for the lowest rate. The rate you will receive (ranging from 6.34% – 8.24% APR with auto-pay) is based on the term of the loan, if the loan is cosigned (which lowers your rate), if you are a Rhode Island resident (which lowers your rate), your credit score & financial history, your cosigner's credit score (if applicable), and other factors. The rate shown is for a 5-year term. The first payment will be due approximately 30 days after the loan is completely disbursed. The rates and terms disclosed above are available while funds last. New funds may be subject to different rates and/or terms.

2. THE ANNUAL PERCENTAGE RATE (APR) - Undergraduate DEFERRED REPAY: Reflects the estimated total cost of the loan, including upfront fees ($0), accruing interest, and the effect of capitalized interest. Interest begins accruing after each loan disbursement. Rates shown include the 0.25% interest rate reduction for using the auto-pay feature. If the monthly payment is calculated to be less than $50 per month for a full term, the lowest payment is $50 per month with the term reduced. Not all borrowers qualify for the lowest rate. The rate you will receive (ranging from 7.30% - 8.52% APR with auto-pay) is based on the term of the loan, if you are a Rhode Island resident or go to school in Rhode Island (which lowers your rate), your credit score & financial history, your cosigner's credit score (if applicable), and other factors. APR for Graduate student loan refinancing may differ. The rates and terms disclosed above are available while funds last. New funds may be subject to different rates and/or terms.