For Students

FAFSA Completion Guide

Get the assistance you need with FAFSA! Our comprehensive guide expertly walks you through every section of the FAFSA, ensuring you complete it accurately to secure the highest possible financial aid for college! For in-person or phone assistance with FAFSA completion, schedule an appointment today!

Required FAFSA Information

It's always good to be prepared!

We have provided a list of must-have documents to complete your FAFSA. Completing the FAFSA will determine student eligibility for grants, scholarships, federal student loans, and work-study.

Download our FAFSA Checklist to help you keep on track!

You can create your FSA ID at studentaid.gov. Note that students and parents must create their own FSA ID and keep it private.

Your Social Security Number, Driver's License, and Alien Registration Number if you are not a U.S. citizen.

Your federal income tax returns, W-2s, and other records of money earned.

Your parent's income tax returns, W-2 forms, and 1040 forms if you’re a dependent.

Bank statements and records of investments (if applicable).

Records of untaxed income (if applicable).

Title IV Institution Codes for each school you’re applying to, which you can find from the FAFSA federal school code search.

RISLA College Planning Center

Schedule an appointment with one of our experts.

The RISLA College Planning Center (CPC) is here to help students achieve their higher education dreams! We offer complimentary FAFSA completion appointments for parents and students—let’s make those goals a reality together!

Preview of 2025-2026 FAFSA Form

Dependent Student Invites Parent

FAFSA Form | Home & Login

Let's start with the basics.

Below are visuals from studentaid.gov to help you understand how to create a new account and log in.

Dependent Student | FAFSA Landing Page

FAFSA FORM LANDING PAGE

- This is the main landing page for the FAFSA form.

- This page directs students to "Start a New Form" or "Edit Existing Form."

- For this presentation, the student is beginning a new application.

Dependent Student | Login

LOGIN PAGE

- If the student selects "Start a New Form" from the FAFSA landing page and is not logged in to StudentAid.gov, they are taken to the “Log In” page to enter their login credentials.

- All students are required to have an FSA ID (account username and password) to access the FAFSA form.

- If students don't have an FSA ID, they can select "Create an Account."

Step 01 | Dependent Student | Roles

To help you prepare for the FAFSA, we have provided a preview of the FAFSA form. It’s important to fill out the FAFSA as soon as you can, even if your state and school deadlines are far away. Some states and schools may run out of financial aid, so don’t wait until the last minute to apply!

Dependent Student | Roles

I AM STARTING THE FAFSA AS A

- After logging in, the student can select the applicable role to fill out the FAFSA form: “Student “ or "Parent.“

- The student selects “Student."

Step 02 | Dependent Student | Onboarding

The Student Onboarding section offers a detailed guide for completing the FAFSA. It includes information on contributions from students and parents, what to expect during the process, and the steps to take after submitting the FAFSA.

Dependent Student Onboarding | Section 01

WHAT IS THE FAFSA FORM?

- When students start the 2025–26 FAFSA form for the first time, they are taken through the FAFSA onboarding process.

- The first onboarding page provides an overview of the FAFSA form and an accompanying video.

- WATCH STUDENTAID.GOV FAFSA OVERVIEW >

Dependent Student Onboarding | Section 02

CONTRIBUTORS TO THE FAFSA FORM

- The second FAFSA onboarding page provides information about the different roles that may be required to participate in the student’s FAFSA form and documents that may be needed to complete the form, including an accompanying video that explains contributors and information on how the student will invite them.

- Documents that may be needed to fill out the form are also included on this page.

- WATCH STUDENTAID.GOV VIDEO >

Dependent Student Onboarding | Section 03

WHAT TO EXPECT

-

The third FAFSA onboarding page provides information about what the student can expect when completing their FAFSA form.

- This includes information about consent and approval, a time estimate for completing the form, and that they can save the form and return later if needed, along with an accompanying video.

- WATCH STUDENTAID.GOV VIDEO >

Dependent Student Onboarding | Section 04

AFTER SUBMITTING THE FAFSA FORM

- The last FAFSA onboarding page provides information about what to expect once the FAFSA form is completed, submitted, and processed.

- On this page, the student can select "Start the FAFSA Form" to begin.

- WATCH STUDENTAID.GOV VIDEO >

Step 03 | Dependent Student | Identity

The Student Identity Information section requires your name, date of birth, and other personal details. If you have previously completed the FAFSA form or logged in using your FSA ID, much of your information will be automatically filled in to save you time. Make sure to enter your personal information exactly as it appears on your Social Security card—no nicknames allowed.

Dependent Student | Identity Information

STUDENT IDENTITY INFORMATION

- This is the first page within the student section.

- The student can verify that their personal information is correct.

- To update any of the personal information, the student must access their Account Settings on StudentAid.gov.

Step 04 | Dependent Student | State of Legal Residence

The Student is required to select their legal State of residence.

Dependent Student | State of Legal Residence

STUDENT STATE OF LEGAL RESIDENCE

- The student is asked about their state of legal residence.

- The student selects the state from a drop-down box and provides the month and year when they became a legal resident.

Step 05 | Dependent Student | Provides Consent & Approval

Dependent Student must consent to retrieve and disclose Federal Tax Information (FTI). Student consent allows studentaid.gov to obtain tax return information from the IRS automatically. By providing consent, students become eligible for federal student aid, which includes grants and loans.

Dependent Student | Provides Consent

STUDENT PROVIDING CONSENT FOR FEDERAL TAX INFORMATION (FTI)

-

This page informs the student about consent, approval, and the use of their federal tax information.

-

By providing consent and approval, the student’s federal tax information is transferred directly into the FAFSA form from the IRS to help complete the "Student Financials" section.

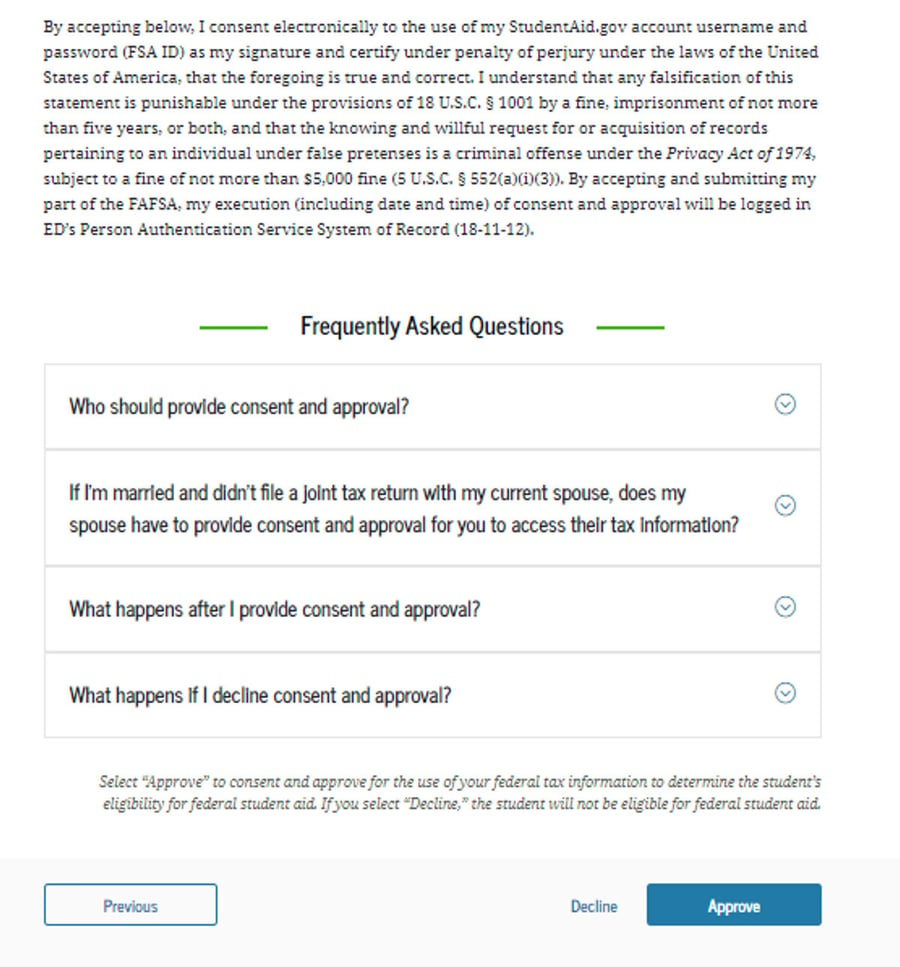

Dependent Student | Student Approval

STUDENT APPROVAL

-

This is a continuation of the consent and approval page.

-

Frequently asked questions about consent and approval are also provided so the student can expand and collapse.

-

The student selects "Approve" to provide consent and approval and is taken to the next page.

Step 06 | Dependent Student | Imports IRS Information

A dependent student must import their most recent tax information into the FAFSA.

Dependent Student | Imports IRS Information

STUDENT IMPORTING IRS TAX INFORMATION

-

This page imports the student’s federal tax information by directly transferring it into the FAFSA form from the IRS to help complete the "Student Financials" section.

Dependent Student | Imports IRS Information Continued

STUDENT IMPORTING IRS TAX INFORMATION CONTINUED

-

This page displays the results from the IRS import for the student.

-

For this scenario, the student is starting a new FAFSA form and there is no federal tax information available from the IRS.

Step 07 | Dependent Student | Personal Circumstance

Share information about your marital status, financial dependencies, college plans, and any circumstances that might influence your eligibility for aid.

Dependent Student | Personal Circumstances

YOUR PERSONAL CIRCUMSTANCES

- This is the first page within the Student Personal Circumstances section.

- It provides an overview of the section.

Dependent Student | Marital Status

STUDENT MARITAL STATUS

- The student is asked about their marital status.

- The student selects the "Single (Never Married)" option.

Dependent Student | College or Career School Plans

STUDENT COLLEGE OR CAREER SCHOOL PLANS

- The student is asked about their college grade level for the 2025–26 school year and if they will have their first bachelor’s degree.

- For this example, the student selects that they will be a "First Year (freshman)" and that they will not have their first bachelor’s degree.

Dependent Student | Personal Circumstances

STUDENT PERSONAL CIRCUMSTANCE

- The student is asked if any of the listed personal circumstances apply to them.

- For this example, the student selects the "None of these apply" option.

Dependent Student | Homelessness

STUDENT HOMELESSNESS

-

The student is asked if they are homeless or at risk of being homeless. The student selects "No."

Dependent Student | Unusual Circumstances

STUDENT UNUSUAL CIRCUMSTANCES

- The student is asked if they are homeless or at risk of being homeless.

- For this example, the student selects "No."

Step 08 | Dependent Student | Student Dependency Status

The student is asked if they want the financial aid office to determine their eligibility for a Direct Unsubsidized Loan. This is an alternative option if the student's parents are reluctant to provide information and financial support.

Dependent Student | Dependency Status

STUDENT DEPENDENCY STATUS

- Based on the answers provided by the student, they are considered a dependent student.

- The student is asked if they want a financial aid administrator to determine their eligibility for a Direct Unsubsidized Loan only.

- This is an option if the student’s parents are unwilling to provide information.

- The student selects "No," and if the student had selected “Yes,” a modal would appear to warn them about missing out on other potential federal student aid.

Dependent Student | About Your Parent

TELL US ABOUT YOUR PARENTS

- As the student is considered dependent, they are asked to provide information about their parents.

- The FAFSA form considers their “Parent” to be their legal (biological or adoptive) parent.

- The student is asked if their parents are married.

- The student selects "Yes" and is required to invite their parents to their FAFSA form to complete the required parent sections.

Dependent Student | Invites Parents to FAFSA Form

INVITE PARENTS TO THE FAFSA FORM

- The student is asked to enter personal information about their parents to send them an invite to their FAFSA form.

- In this scenario, the student invites one parent.

Step 09 | Dependent Student | Demographics

Dependent students will need to answer information about themselves and their parents. Some of these questions will help determine how much federal student aid they may be eligible to receive for college.

Dependent Student | Demographics Introduction

STUDENT DEMOGRAPHICS

- This is the first view within the "Student Demographics" section.

- It provides an overview of the section.

Dependent Student | Demographic Information

STUDENT DEMOGRAPHICS INFORMATION

-

The student is asked about their gender identity.

-

The student selects “Prefer not to answer.”

Dependent Student | Race & Ethnicity

STUDENT RACE & ETHNICITY

- The student is asked if they are of Hispanic, Latino, or Spanish origin.

- They are also asked about their race.

- The student selects checkboxes to answer both questions.

Dependent Student | Citizenship

STUDENT CITIZENSHIP

- The student is asked about their citizenship status.

- The student selects the "U.S. Citizen or National" option.

Dependent Student | Parent Education Status

PARENT EDUCATION STATUS

- The student is asked about their parents’ education status.

- The student selects the “Neither parent attended college” option.

Dependent Student | Parent Killed in Line of Duty

PARENT KILLED IN LINE OF DUTY

- The student is asked if their parent was killed in the line of duty.

- The student selects "No" option.

Dependent Student | High School Completion Status

STUDENT HIGH SCHOOL COMPLETION STATUS

- The student is asked about their high school completion status when they start the 2025–26 school year.

- The student selects the "High School Diploma" option.

Dependent Student | High School Information

STUDENT HIGH SCHOOL INFORMATION

- The student is asked which high school they did or will graduate from.

- The student enters their high school’s state and city.

- After selecting "Search," they select the correct high school from the search results.

Dependent Student | Confirms High School

CONFIRM YOUR HIGH SCHOOL

- The student can edit the high school information presented on this page by selecting "Edit," which will return them to the high school information page.

- The student confirms their high school information and selects "Continue" to proceed to the next section.

Step 10 | Dependent Student | Financials

The FAFSA form assesses the student's ability to pay for college, including personal investments, real estate, and other assets, excluding financial aid and state/federal benefits.

Dependent Student | Financials Introduction

STUDENT FINANCIALS

- This is the first page within the Student Financials section.

- It provides an overview of the section.

- The student can select the hyperlink if they want to learn about special financial circumstances.

Dependent Student | Tax Filing Status

STUDENT TAX FILING STATUS

-

The student is asked about their tax filing status.

-

The student selects "Yes" to "Did or will the student file a 2023 IRS Form 1040 or 1040-NR?"

Dependent Student | Tax Return Information

STUDENT TAX RETURN INFORMATION

- The student is asked questions about their recent tax return.

- The student selects "Single" as their filing status.

- The student is asked about their taxes, income, and other financial information.

- The student enters dollar amounts in the responses.

Dependent Student | Assets

STUDENT ASSETS

- The student is asked about their assets.

- The student enters a response in each entry field.

Step 11 | Dependent Student | Selects Colleges

In this section, students can search and select schools they are considering attending. Once the student has completed their FAFSA, the selected schools will automatically receive an electronic copy.

Dependent Student | Selects Colleges

STUDENT SELECTS COLLEGES

- This is the first page in the Select Colleges section, which is the final part of the FAFSA form’s student section to require information.

- It provides an overview of the section.

Dependent Student | College Search

SENDING THE FAFSA TO WHAT COLLEGES

- The student is asked to search for the colleges and/or career schools they would like to receive their FAFSA information.

- The student searches for a school by entering a state, city, and/or school name and selecting "Search," the student selects the correct school(s) from the search results.

- If the student can’t find a school by searching by school name or state, they can search by school code.

- The student must add at least one college or career school to continue.

- Students can select to send their FAFSA information to a maximum of 20 schools.

- After the student selects the correct school(s) from the search results, they can review their chosen school(s) before continuing.

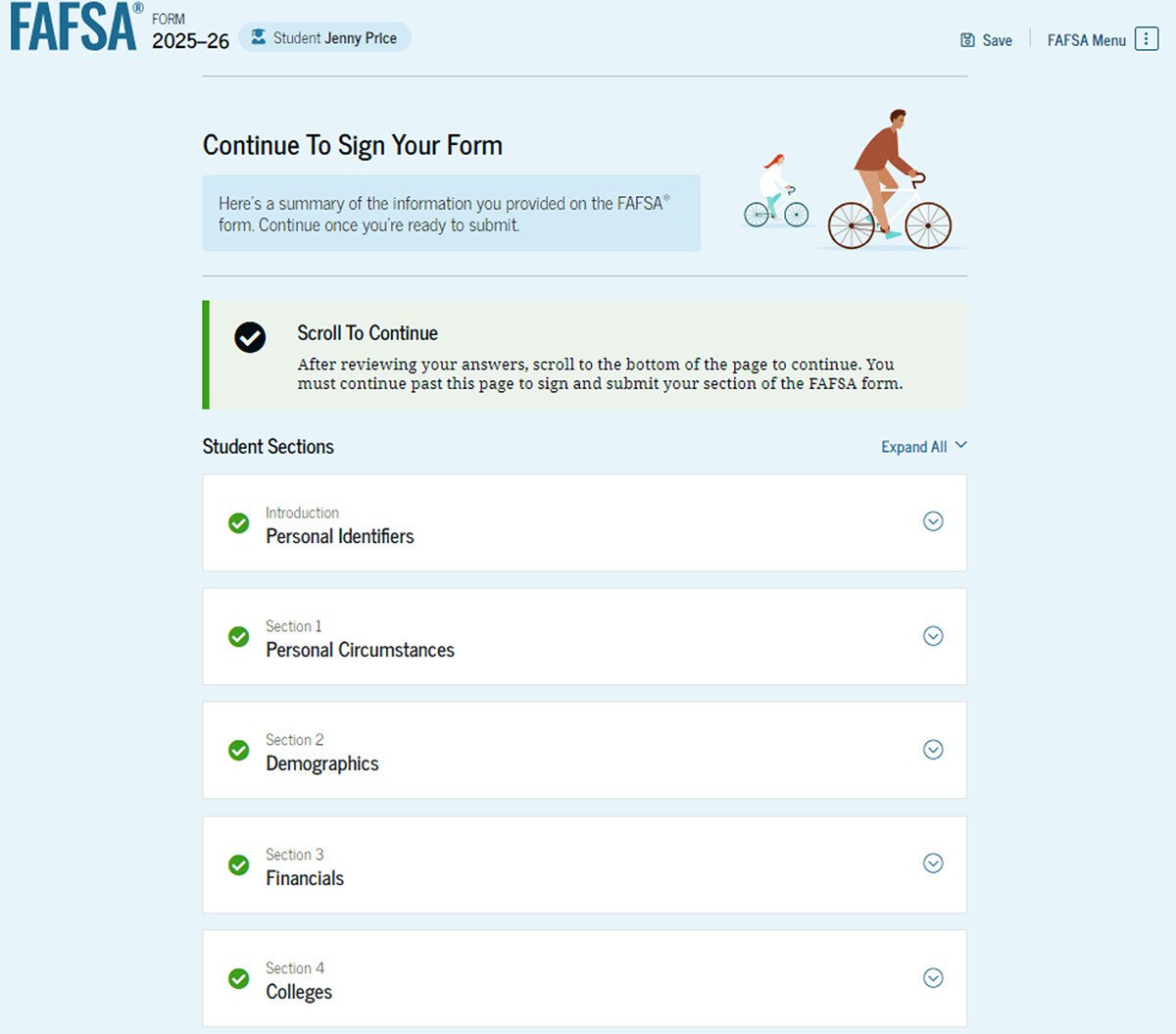

Step 12 | Dependent Student | Review Page

Students should review the information entered. Incorrect information could prolong the FAFSA process.

Dependent Student | Review Page

REVIEWING INFORMATION BEFORE SIGNING

- The review page displays the student's responses in the FAFSA form.

- The student can view all their responses by selecting "Expand All" or expanding each section individually.

- To edit a response, the student can select the question’s hyperlink and will be taken to the corresponding page.

- Additionally, since the student invited their parent into the form, they see the parent contributor section and the status of their parent’s invite.

Dependent Student | Signature

SIGN AND COMPLETE STUDENT PART

-

On this page, the student reviews the terms and conditions of the FAFSA form and what they’ll agree to if they sign the form.

-

After agreeing to the terms and conditions of the FAFSA form and signing, the student is able to submit their section of the FAFSA form.

- Since parent information has not been provided, the FAFSA form is not considered complete and can’t be processed yet.

Dependent Student | Section Complete

THE STUDENT SECTION IS COMPLETE

- Upon signing the student section, the student is presented with the student section complete page.

- This page displays information for the student about next steps, including tracking their FAFSA form.

- This page displays information for the student about next steps, including checking their email and a reminder that their FAFSA form is not completed and can’t be submitted until the parent completes the contributor section of the form and signs it.

- Next, in this scenario, the student’s invited parent will enter the FAFSA form and complete the parent section.

Step 13 | Dependent Student | Parent Email

Dependent Student | Parent Email

PARENT FAFSA EMAIL INVITATION

- This is NOT a view within StudentAid.gov nor the FAFSA form.

- This view demonstrates a parent opening the FAFSA invitation from their email.

- The parent selects “Log In" and is taken to StudentAid.gov.

Dependent Student | Parent Login

PARENT FAFSA LOGIN

- The parent is taken to the “Log In” page from their email to enter their login credentials.

- To access the FAFSA form, all users are required to have an FSA ID (account username and password).

- If the parent doesn't have an FSA ID, they can select "Create an Account."

Dependent Student | My Activity

PARENT ADDED AS CONTRIBUTOR TO DEPENDENT STUDENT FAFSA FORM

- After successfully logging in, the parent is taken to their “My Activity” page.

- The parent sees an invitation to be a contributor on the student’s FAFSA form.

- When the parent selects "Accept Invitation," a pop-up window appears to remind the parent that their personal information is needed to fill out the student’s FAFSA form.

- The parent selects "Continue" to agree to share their information and enters the FAFSA form.

Step 14 | Dependent Student | Parent Onboarding

Dependent Student | Parent Onboarding | Section 01

WHAT IS THE FAFSA FORM?

- When the parent enters a 2025–26 FAFSA form for the first time, they are taken through the FAFSA onboarding process.

- The first onboarding page provides an overview of the FAFSA form and an accompanying video.

- WATCH STUDENTAID.GOV FAFSA OVERVIEW >

Dependent Student | Parent Onboarding | Section 02

CONTRIBUTORS TO THE FAFSA

-

The second FAFSA onboarding page provides information about contributors who may be required to participate in the student’s FAFSA form, including an accompanying video explaining contributors and information on how the parent will invite them.

-

Documents that may be needed to fill out the form are also included on this page.

- WATCH STUDENTAID.GOV VIDEO >

Dependent Student | Parent Onboarding | Section 03

WHAT TO EXPECT

- The third FAFSA onboarding page provides information about what the parent can expect when completing the student’s FAFSA form.

- This includes information about consent and approval, a time estimate to complete the form, the ability to save the form and return it later if needed, and an accompanying video.

- WATCH STUDENTAID.GOV VIDEO >

Dependent Student | Parent Onboarding | Section 04

AFTER SUBMITTING THE FAFSA FORM

- The last onboarding page provides information about what to expect once the FAFSA form is completed, submitted, and processed.

- On this page, the parent selects "Start FAFSA Form" to begin the parent section.

- WATCH STUDENTAID.GOV VIDEO >

Step 15 | Dependent Student | Parent Identity Information

The Parent Identity Information section includes your name, date of birth, etc. If you either completed the FAFSA form in the past or logged into the FAFSA form with your FSA ID, most of your personal information will pre-populate to save you time. Be sure to enter your personal information exactly as it appears on your Social Security card.

Dependent Student | Parent Identity Information

PARENT IDENTITY INFORMATION

- This is the first page within the parent section.

- The parent can verify that their personal information is correct.

- To update any of the personal information, the parent must access their Account Settings on StudentAid.gov.

- For fields related to the parent’s mailing address, the parent can edit them directly on this page.

Step 16 | Dependent Student | Parent Provides Consent & Approval

The Parent Identity Information section includes your name, date of birth, etc. If you either completed the FAFSA form in the past or logged into the FAFSA form with your FSA ID, most of your personal information will pre-populate to save you time. Be sure to enter your personal information exactly as it appears on your Social Security card.

Dependent Student | Parent Provides Consent & Approval

PARENT PROVIDING CONSENT FOR FEDERAL TAX INFORMATION (FTI)

- This page informs the parent about consent, approval, and the use of their federal tax information.

- By providing consent and approval, the parent’s federal tax information is transferred directly into the FAFSA form from the IRS to help complete the "Parent Financials" section.

- The parent selects "Approve" to provide consent and approval, and they are taken to the next page.

- Frequently asked questions about consent and approval are also provided so that the parent can expand and collapse.

Step 17 | Dependent Student | Parent Imports IRS Information

Dependent Student | Parent Imports IRS Information

PARENT IMPORTS IRS INFORMATION

- This page imports the parent’s federal tax information by directly transferring it into the FAFSA form from the IRS to help complete the “Parent Financials" section.

- It will display the results from the IRS import for the parent.

- For this scenario, the parent is contributing to a new FAFSA form, and no federal tax information is available from the IRS.

Step 18 | Dependent Student | Parent Demographics

The parent will need to answer information about themselves. Some of these questions will help determine how much federal student aid may be eligible to receive for college.

Dependent Student | Parent Demographics

PARENT DEMOGRAPHICS

- This is the first view within the Parent Demographics section.

- It provides an overview of the section.

Dependent Student | Parent Current Marital Status

PARENT CURRENT MARITAL STATUS

- The parent is asked about their current marital status.

- They select the "Married (not Separated)" option.

Dependent Student | Parent State of Legal Residence

PARENT STATE OF LEGAL RESIDENCE

- The parent is asked about their state of legal residence.

- The parent selects the state from a dropdown box and provides the month and year they became legal residents.

Step 19 | Dependent Student | Parent Financials

The parent will need to answer information about themselves. Some of these questions will help determine how much federal student aid may be eligible to receive for college.

Dependent Student | Parent Financials

PARENT FINANCIAL SECTION

- This is the first page within the Parent Financials section.

- It provides an overview of the section.

Dependent Student | Parent Federal Benefits

PARENT FEDERAL BENEFITS RECEIVED

- This page asks the parent if they or anyone in their family has received federal benefits.

- The parent selects "None of these apply."

Dependent Student | Parent Tax Filing Status

PARENT TAX FILING STATUS

- This page asks the parent about their tax filing status.

- The parent selects "Yes" to "Did or will the parent file a 2023 IRS Form 1040 or 1040-NR?" and “Yes” to “Did or will the parent file a 2023 joint tax return with their current spouse?”

Dependent Student | Parent Family Size

PARENT FAMILY SIZE

- This page displays the family size for the student.

- The parent has the option to enter the number of children or other dependents who live with the parent and will receive more than half of their support from the parent between July 1, 2025, and June 30, 2026.

Dependent Student | Parent Number in College

PARENT NUMBER IN COLLEGE

- This page asks the parent how many people in the family will be in college between July 1, 2025, and June 30, 2026.

- The parent enters a response into the entry field.

Dependent Student | Parent Tax Return Information

PARENT TAX RETURN INFORMATION

- The parent is asked questions about their 2023 tax return.

- The parent enters a response in each entry field.

Dependent Student | Parent Assets

PARENT ASSETS

- The parent is asked about their assets.

- The parent enters a response in each entry field.

Dependent Student | Parent Other Information

PARENT OTHER INFORMATION

- The parent is asked to provide information about their spouse or partner. In this example, the other parent does not need to contribute to the student’s FAFSA form because the parents filed taxes jointly.

- After providing the other parent’s information, all required parent information will be complete.

Step 20 | Dependent Student | Parent Review Page

Parents should carefully review the information entered before signing.

Dependent Student | Parent Signature

PARENT Review page

- The review page displays the responses that the parent has provided in the FAFSA form.

- The parent can only view responses within the parent section of the student’s FAFSA form.

- The parent can view all their responses by selecting "Expand All" or expand each section individually.

- To edit a response, the parent can select the question’s hyperlink to be taken to the corresponding page.

Step 21 | Dependent Student | Parent Signature

Parents should carefully review the information entered before signing.

Dependent Student | Parent Signature

PARENT SIGNATURE

- On this page, the parent acknowledges the terms and conditions of the FAFSA form and signs their section.

- Since all required sections are complete, the parent can both sign and submit the student’s FAFSA form.

Step 22 | Dependent Student | FAFSA Confirmation

Congratulations! You have completed your FAFSA! Now you will receive your confirmation email, Notification of FAFSA Processing, and college updates and notifications.

Dependent Student | FAFSA Confirmation

FAFSA CONFIRMATION

- Upon submitting the student’s FAFSA form, the parent has an abbreviated confirmation page.

- This page displays information about tracking the student’s FAFSA form and next steps.

- The student will receive an email with the full, detailed confirmation.

- With the student and parent sections completed and signed, the FAFSA form is now considered complete and submitted for processing.

FAFSA Submission Summary

The student will receive a FAFSA Submission Summary and will review Eligibility Overview, FAFSA Form Answers, School Information, and Next Steps. It is important to review and update any information that may need correction.

FAFSA Submission Summary | Landing Page

LANDING PAGE

-

The student receives a FAFSA Submission Summary for their processed FAFSA form and any subsequent corrections that they submit.

-

The FAFSA Submission Summary is broken into four tabs: “Eligibility Overview,” “FAFSA Form Answers,” “School Information,” and “Next Steps.”

-

At the top, the student will see when their form was received and processed. They also have the option to print their FAFSA Submission Summary to keep for their records.

FAFSA Submission Summary | Eligibility Overview

ELIGIBILITY OVERVIEW

-

On the "Eligibility Overview" tab, the student sees information about what federal student aid they may be eligible for, such as a Federal Pell Grant and Federal Direct Loans.

-

Any amounts of financial aid that display on this tab are estimates and are not guaranteed.

-

Final determination of the student’s financial aid eligibility is provided by their school’s financial aid office.

- They are also able to view their Student Aid Index.

FAFSA Submission Summary | Form Answers

FAFSA FORM ANSWERS

-

On the "FAFSA Form Answers" tab, the student sees the answers that they provided on their FAFSA form.

-

If any of the provided answers are incorrect, the student can choose to make a correction.

FAFSA Submission Summary | Form Answers Contributors

FAFSA FORM ANSWERS CONTRIBUTORS

-

This is a continuation of the "FAFSA Form Answers" tab.

-

If applicable, student sees the answers their contributor(s) provided on their FAFSA form. I am running a few minutes late; my previous meeting is running over.

FAFSA Submission Summary | School Information

SCHOOL INFORMATION

-

On the "School Information" tab, the student sees information about the college(s) and/or career school(s) that they selected to send their FAFSA information.

-

The student can compare the graduation rate, retention rate, transfer rate, default rate, median debt upon completion, and average annual cost of their selected schools.

FAFSA Submission Summary | Next Steps

NEXT STEPS

-

On the "Next Steps" tab, the student sees comments that pertain to their FAFSA form.

-

Some comments may require the student to make a correction or send additional documentation to their school.

-

Other comments may be informational and do not require any further action from the student.

FAFSA Submission Summary | More Resources

MORE RESOURCES

-

Lastly, along the right side of their FAFSA Submission Summary, the student can access additional resources, including visiting “My Aid” or College Scorecard.